Dry Bulk Market: Freight Rates and Ships’ Prices on the Rise

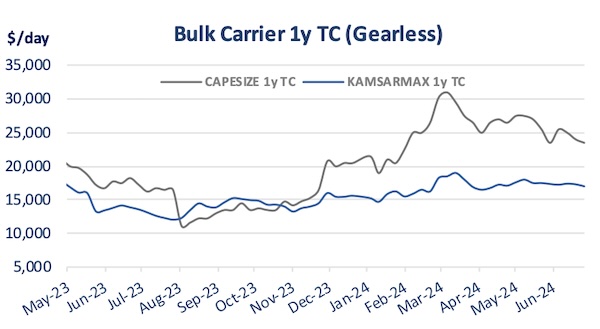

ATHENS : The dry bulk market is witnessing a “euphoria” phase of past times, with freight rates and asset prices on the rise over the past few weeks. In its latest weekly report, shipbroker Xclusiv said that “the dry bulk market has exhibited significant strength over the past year, with an upward trend fostering optimism among both owners and charterers. The Baltic Dry Index (BDI) reflects this positive sentiment, with a 72% increase from 1,183 points on June 27, 2023, to 2,031 points on June 27, 2024. Similar positive trends are observed across individual vessel segments. The Capesize market, represented by the Baltic Capesize Index (BCI), has climbed 74% year-on-year, reaching 3,371 points on June 27, 2024, compared to 1,937 points on the same date in 2023. The Panamax market has also experienced notable growth, with the Baltic Panamax Index (BPI) rising 54% within a year, reaching 1,672 points on June 27, 2024, from 1,089 points on the corresponding date in 2023. The Supramax segment has witnessed the most impressive gains, with the Baltic Supramax Index (BSI) surging 88% to 1,399 points on June 27, 2024, compared to 746 points a year prior. The Baltic Handysize Index (BHSI) has also seen significant growth, climbing 68% from 454 points to 763 points over the same period”, the shipbroker noted.

According to Xclusiv’s analysis, “the recent surge in freight rates and overall market optimism has had a ripple effect, positively impacted the secondhand market and driving up vessel prices. Five-year-old Capesize vessels, for example, are now valued between USD 61-64 million (depending on the country of built and vessel’s characteristics), a significant 32% increase compared to June 2023 and a staggering 83% jump since the initial COVID-19 lockdown in June 2020. This trend extends across other segments as well. Kamsarmax vessels of the same age range have seen a 22% price increase year-on-year, reaching USD 35-38 million, and a remarkable 75% increase since June 2020. Even smaller vessels haven’t been immune to this price surge. Five-year-old Ultramaxes are currently priced at USD 35-37 million, representing a 25% rise compared to last year and a near doubling (93%) from their June 2020 value”.

“Similarly, five-year-old Handysize vessels are commanding prices between USD 26.5-28.5 million, reflecting a 15% year-on-year increase and a hefty 90% jump since June 2020. This data paints a clear picture of a buoyant secondhand market fueled by the current positive sentiment in the dry bulk shipping industry. Interestingly, even though the Baltic Exchange Indices suggest similar freight market conditions to those of the second half of 2022, prices for secondhand vessels tell a different story. In late May 2022, the BCI mirrored current levels, yet five-year-old Capesize vessels were priced 21% lower compared to today’s market. Similarly, the five-year-old Kamsarmax vessels back in August 2022 were priced 16% lower than today, despite the BPI was at the region of 1680 points. While the BSI and the BHSI stood at similar levels in November 2022 compared to today, the secondhand market for five-year-old Ultramax and Handysize vessels presented a significantly different picture, with their prices 33% and 21% lower than today respectively”, Xclusiv said.

The shipbroker concluded that “although prices have gone north during the past year, the dry S&P activity has experienced great momentum during the first half of 2024 with a total of 435 bulk carrier vessels finding new owners, almost 40% up compared to the same period of 2023. Supramax and Handysize segments were the main preference of the shipowners, with 107 and 101 sales respectively, having noted an increase of around 39% and 26% compared to the first half of 2023. Within 2024 so far, buying appetite has turned to larger vessels, with Kamsarmax and Post-Panamax sales being 68% and 283% up compared to the first half of 2023, while Capesize and Newcastlemax sales have increased by 40% and 136%, correspondingly. Although sales increased across all segments, the Ultramax sector is slightly down (about 11% year-on-year)”.