Strong container throughput drives Port of Antwerp-Bruges growth despite challenging market conditions

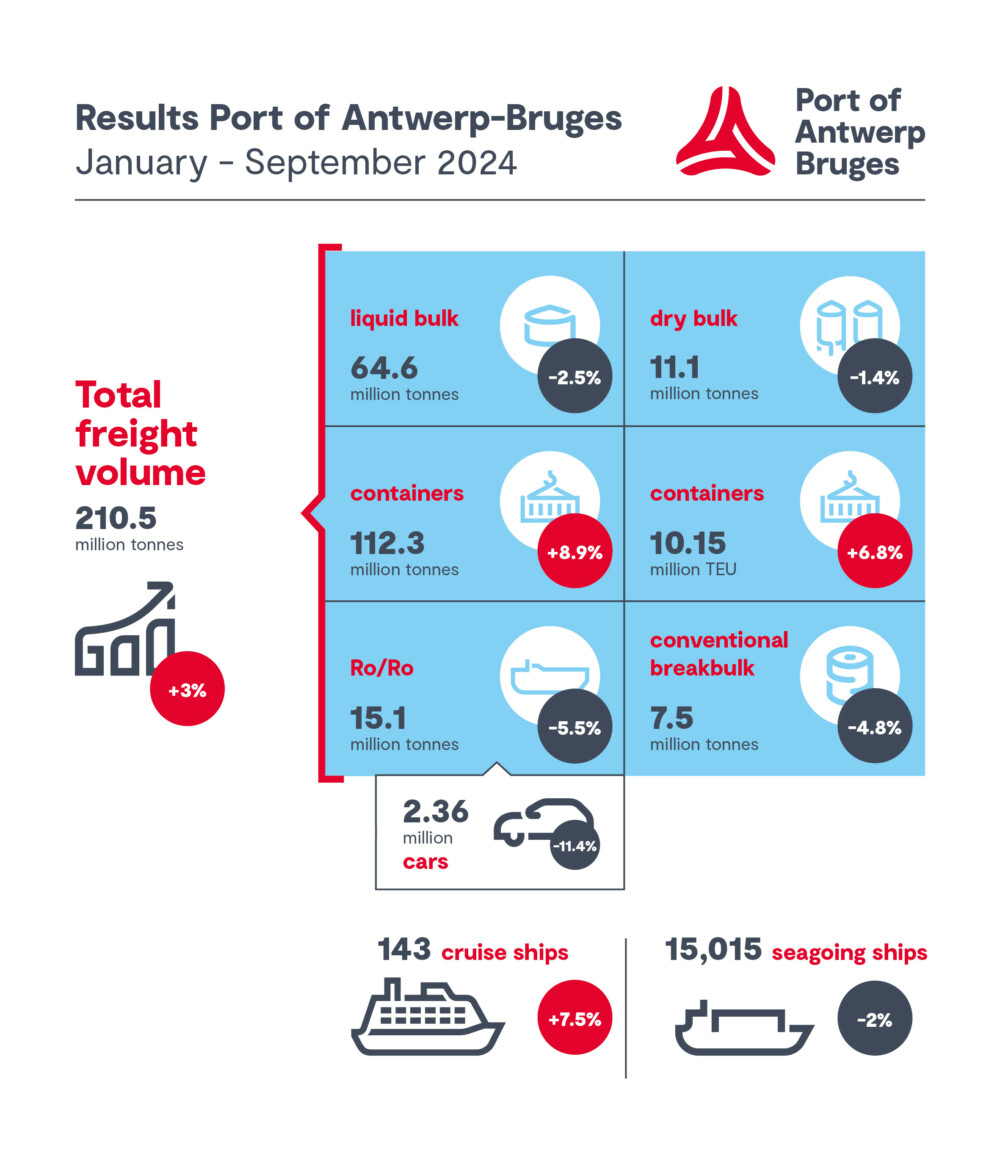

ANTWERP : After nine months, Port of Antwerp-Bruges saw a total throughput of 210.5 million tonnes, an increase of 3% compared to the same period last year and a stabilisation in comparison to the second quarter of 2024. Demand for container transport remains strong, while the ongoing geopolitical and economic instability impacts other cargo types. Despite these challenges, the port continues to invest in sustainable and innovative projects to support energy transition and industrial growth.

Container throughput in tons increased by 8.9%, with imports increasing by 10.2% and exports by 7.9%. The growth in the first half of the year continued in the third quarter, with 12.3% more containers handled (TEUs) than in the same quarter last year. Over the first nine months, total container throughput in TEUs increased by 6.8% to 10,152,000 TEUs.

In the first half of this year, Port of Antwerp-Bruges’ market share in container handling in the Hamburg – Le Havre Range grew by 0.8 percentage points compared to 2023, to 30.7%.

Nearly 1 in 10 of the containers handled is a reefer container. In the first nine months of 2024, the number of full reefers increased by 9.7%, accounting for 8.5% of total container throughput. These temperature-controlled containers carry products such as fresh fruits, vegetables, meat, fish, pharmaceuticals and chemicals. Thanks to its strategic location, fast maritime connections and specialist terminals, Port of Antwerp-Bruges confirms its strong position in the reefer segment.

Although conventional general cargo performed strongly in the second quarter, throughput fell in the third quarter, bringing total throughput for the first nine months of 2024 down by 4.8% compared to last year. Iron and steel decreased slightly by 0.6%, with increased exports (+4%) partially offsetting lower imports (-3.5%). This decline is due to a lower demand from steel processing sectors such as construction and automotive. Products such as wood (-32.9%), paper and cellulose (-22.6%) and construction materials (-36.9%) also saw a decline, while non-containerised throughput of fruit, vegetables and other refrigerated cargo increased by 4.1%.

Roll-on/roll-off traffic dropped by 5.5%. While pressure on car terminals eased, this was due to reduced imports, not due to increased demand from customers. Throughput of transport equipment declined by 13.3%, high & heavy by 23.5%, trucks by 10.3%, and used cars by 42.6%. New car shipments, which surged in 2022 and 2023, fell by 11.4% in the first nine months of this year. Throughput of unaccompanied cargo (excluding containers) on RoRo vessels in Zeebrugge rose by 2.8%. The decline in traffic to and from the United Kingdom (-4.1%) was amply offset by an increase in throughput to and from Spain and Portugal (+35.7%), Scandinavia (+16.7%) and Ireland (+2.2%).

Throughput of dry bulk fell by 1.4%, mainly due to a sharp drop in throughput of coal (-55.3%). Indeed, dry bulk, excluding energy products such as coal and wood pellets, grew by 9.5%. Fertilisers, the largest product category in this segment, continued its growth (+30.6%) after a sharp decline in 2022 due to sanctions and high gas prices. Other building materials and non-ferrous ores also grew by 7.3% and 4.8%, respectively, while sand & gravel (+0.1%) and scrap (-0.7%) remained more or less stable.

Liquid bulk throughput fell by 2.5% after nine months, due to lower volumes of liquid fuels (-8.9%) and LNG (-10.2%). Diesel throughput (-23.1%) in particular declined due to weak demand, while LPG (+8.8%), fuel oil (+8.4%), naphtha (+2.9%) and gasoline (+2.3%) showed growth. The throughput of chemicals increased by 9.3%, partly due to the strong increase in the throughput of biofuels (+52.5%). Even without this effect, chemicals showed growth (+7%). Chemical gases (+9.5%) and basic chemicals (+8.6%) also showed positive trends. Despite this recovery, the European chemicals sector remains under pressure due to high costs for energy, raw materials and wages, combined with low global demand.

In the first nine months of 2024, Zeebrugge welcomed 412,774 cruise passengers (+17.5%) on 143 cruise ships, 10 cruise ships more than last year.

In the first nine months of 2024, 15,015 ocean-going vessels called at the port, down by 2%. The gross tonnage of these vessels fell by 4.8% to 472.45 million GT.

Focus on energy transition and industrial growth

Despite ongoing geopolitical and economic challenges, Port of Antwerp-Bruges’ growth is stabilising. The figures again underscore the resilience of the port, which in complex times continues to pioneer and invest in a future-proof port where sustainability and economic growth go hand in hand. The expansion of Zuidnatie, which started with the construction of a new warehouse for processing steel coils this summer, and the acquisition of Luik Natie by Lineage, confirm the port’s importance in specialist segments. The recently announced investments, such as Vioneo‘s fossil-free plastics production and Indaver’s Plastics-to-chemicals, which converts polystyrene (PS) and polyolefins (PO) into recycled naphtha, in turn strengthen the port’s position in the energy transition and sustainable innovation.

Port of Antwerp-Bruges will continue to focus on strengthening its infrastructure and offering sustainable logistics solutions that contribute to the industry’s efforts in CO₂ reduction and digitalisation. Following the installation of one of Europe’s largest public charging hubs for electric trucks in Antwerp, the initial foundations were laid in Zeebrugge for a truck park with charging infrastructure. In addition, the CHERISH2O project, which aims to purify and reuse industrial wastewater, is contributing to the port’s development as a circular hub.

Jacques Vandermeiren, CEO Port of Antwerp-Bruges: “Despite the complex times in which we operate, with geopolitical tensions, rising energy prices and global competition, we are stabilising our growth, thanks in part to our strong position in container handling. Sailing around the Cape of Good Hope, cyberattacks and other challenges are forcing us to remain flexible and resilient. Along with our partners, we are continuing to build a future-proof port where innovation supports both sustainability and economic growth. Investments like those of Vioneo and Indaver reflect confidence in our port and in the future of European industry.”