Trump presidency seen as bullish for tanker rates in US, Middle East; Russia wild card

WASHINGTON D. C. : A second Donald Trump presidency could push up tanker rates in the Middle East and the US Gulf while ushering in great uncertainty over Russia-related trades, some analysts recently said based on the former president’s stated views on sanctions and energy.

The Republican candidate is currently running neck and neck in polls with Democratic candidate Kamala Harris, ahead the US elections today Nov. 5. Some observers suggested that Trump could even hold a small edge in some key battleground states.

While Vice President Harris is expected to roughly stay in line with the current Biden administration’s policies, some analysts said Trump’s election could overhaul the business environment for oil shipping with potentially bullish results.

“If Donald Trump wins, there is greater likelihood of a change in US policy,” said Jim Burkhard, Vice President and head of research for oil markets, energy and mobility for S&P Global Commodity Insights. “If he wins, then a huge wave of uncertainty and controversies about the role of the US in the world materializes.”

Iran scenario

Citing one of the possible scenarios, shipbroker BRS said Trump could take a “far more hardline” stance towards Iran to choke off the country’s oil revenues like what he did in his presidency in 2016-2020.

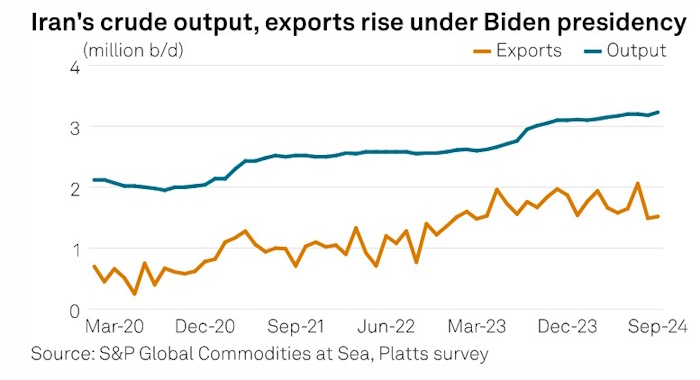

Under the sitting president Joe Biden’s presidency, Iran’s crude production has been gradually increasing and reached 3.23 million b/d in September, the highest this decade, according to the Platts survey by Commodity Insights.

The country’s seaborne crude and condensate exports had also largely been on an upward trajectory post-2020 and stood at 1.5 million b/d last month, before recent disruptions amid the Iran-Israel conflicts, S&P Global Commodities at Sea data shows.

“If Trump was to be elected, his administration would rapidly tighten enforcement of the existing sanctions on Iran’s oil industry,” BRS said in a note Oct. 29 while adding that the measures would target shadow tankers used to transport sanctioned oil.

Such a development could trigger a fall of Iranian exports to near 1 million b/d and allow other OPEC+ producers to raise supplies without flooding the market, according to the shipbroker.

“This should be a positive development for mainstream tanker demand” as those ships could lift crude from other producers in the Middle East Gulf, BRS said, while shadow tankers lose employment opportunities.

Based on BRS’ assessment, 132 VLCCs, 29 Suezmaxes and 26 Aframaxes have lifted sanctioned Iranian crude and condensate over the past two years.

“Many of them could be disposed if demand for them dried up” especially for VLCCs not owned by state-run National Iranian Tanker Co., given that Venezuelan exports are low and Russian trade is well supplied, the shipbroker said.

US exports

Meanwhile, rising US crude production and exports have added to tanker demand in deep sea trades, and some expect further upside if Trump wins the election due to his pro-oil stance.

“A possible Trump presidency is seen as being supportive of even greater oil production,” Gibson Shipbrokers said in a note. “Trump has pledged to roll back restrictions on drilling and permitting which were implemented under the Biden administration, as well as to streamline deregulation and end any [electric vehicle] mandates or green energy incentives.”

The International Energy Agency expects US oil production, including natural gas liquids, to exceed demand by nearly 2.6 million b/d by 2030, and Gibson said the surplus would lead to more long-haul tanker shipments.

“Further policies implemented by a possible Trump administration could add fuel to the fire,” the shipbroker said.

However, as Trump also promises to impose more tariffs on imported goods, US crude exports to China could fall during a tit for tat trade war, according to BRS.

This would threaten incremental ton miles from the US, which are expected to be “a big contributor”” to global VLCC demand in the medium term, BRS said.

Russia

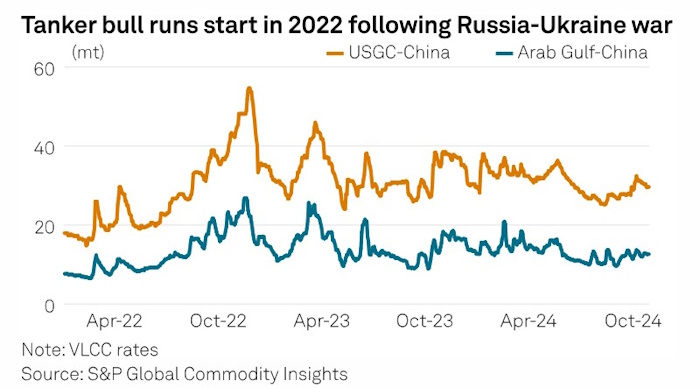

Tanker markets have started a multi-year bull run since Russia invaded Ukraine in February 2022, which have resulted in longer shipments with Russian oil transported to farther destinations rather than its tradition market, Europe, due to an embargo.

Platts, part of Commodity Insights, assessed the VLCC rates on the USG-China route at $29.63/mt and on the Arab Gulf-China route at $12.62/mt on Oct. 28. Both were nearly 65% higher than the levels seen in early 2022.

Trump tightened sanctions on Russia during his presidency, but there has been speculation that the former president would take a softer stance toward the country if he was elected.

The US has played a major role in establishing the G7/EU price cap regime for Russian oil, which targets maritime service providers rather than oil consumers. A collapse of the regime could release shadow tankers back into the markets, leading to rate drops before more old ships are scrapped, depending on the EU’s response.

“The possibility of sharp changes in policy toward Russia, Ukraine and Iran and on trade policy would become much more likely under another Trump administration,” Burkhard said.

“Change, of course, is not inherently good or bad. But it can alter long-standing practices and alliances. The global balance of power is in flux.”

Source : Platts