AD Ports Group delivers record revenue of AED 4.66 billion and total net profit of AED 445 million in Q3 2024

ABU DHABI : AD Ports Group, an enabler of integrated trade, transport and logistics solutions, today reported record levels of revenue and profit in Q3 2024 of AED 4.66 billion and AED 445 million, respectively, driven by strong growth across its core businesses.Condensed Consolidated Profit & Loss

Revenue

- AED 4.66 billion in Q3 2024, +10% Year-on-Year (YoY), +60% normalised for vessel trading activities booked in Q3 2023. On a Like-For-Like (LFL) basis, adjusted for M&A effect & vessel trading activities, Q3 2024 revenue grew 28% YoY.

- The all-time high quarterly revenue was driven by a strong performance across the board, from all Clusters: +24% YoY for Ports, +96% YoY for Maritime & Shipping (normalised for the vessel trading activities in Q3 2024), +16% YoY for Economic Cities and Free Zones, +48% YoY for Logistics, and +62% YoY for Digital.

- 40% of 9M 2024 revenue were long-term/sticky revenue (vs. 46% of H1 2024 revenue), primarily diluted by the strong container shipping business performance.

EBITDA

- AED 1.21 billion in Q3 2024, +60% YoY, +124% normalised for the vessel trading activities in Q3 2023, +63% YoY on a LFL basis adjusted for M&A effect & vessel trading activities.

- EBITDA margin improved from 17.9% in Q3 2023 to 26.0% in Q3 2024 (and vs. 25.6% in Q2 2024).

Profits

- Continued steady growth in Total Net Profit, +11% YoY to AED 445 million in Q3 2024.

- Net Profit after Minorities of AED 301 million, -21% YoY, impacted by a one-off AED 40 million accounting charge related to debt refinancing.

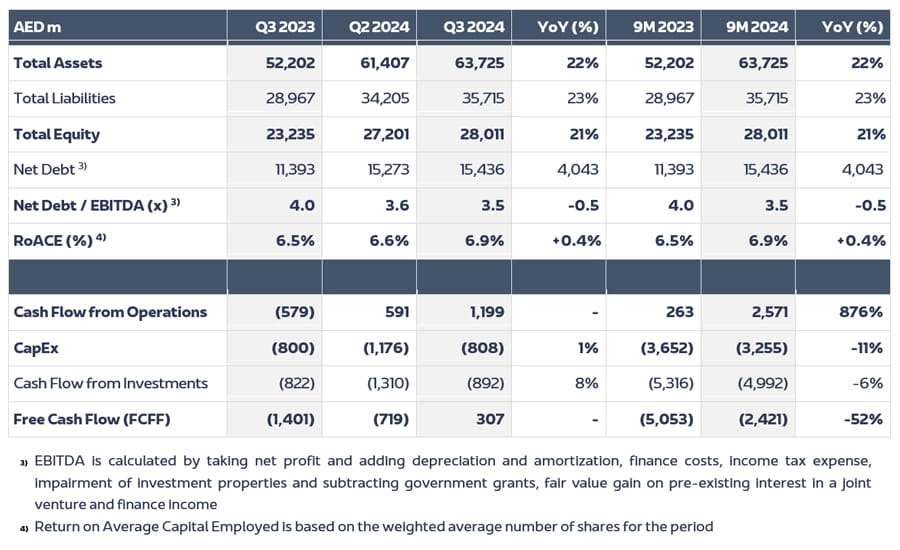

Condensed Consolidated Balance Sheet & Cashflow Statement

Balance Sheet

- 22% YoY growth in Total Assets to AED 63.7 billion in Q3 2024 and 21% YoY increase in Total Equity to AED 28.0 billion.

- Limited increase in total debt and strong EBITDA performance resulted in an improving Net Debt to EBITDA ratio to 3.5x as of Q3 2024 vs. 3.6x in Q2 2024 and 4.0x at the end of the same period last year.

- In September 2024, AD Ports Group strengthened its liquidity position by refinancing and upsizing its syndicate loan and Islamic debt facility amounting to a total of AED 8.2 billion into two new facilities for a total of AED 10.2 billion, lowering spreads and extending maturities to 2026 and beyond.

- AD Ports Group is rated “A+” & “gcAAA” by S&P and “AA-” with Stable Outlook by Fitch.

Cash Flows

- In Q3 2024, Cash Flow from Operations more than doubled Quarter-on-Quarter (QoQ) to AED 1.2 billion driven by strong EBITDA performance and a higher cash conversion ratio of close to 100%.

- Combined with a 31% QoQ drop in Capital Expenditure (CapEx) it resulted in a positive Free Cash Flow of AED 307 million for the quarter.

- AED 808 million was spent on organic growth CapEx in Q3 2024, bringing the YTD outlay to AED 3.3 billion. CapEx guidance remains unchanged at AED 12-15 billion for the next five year, between 2024 and 2028, while CapEx for the year is likely to end at around AED 4.5 billion.

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO, said:

“Our strong third-quarter results, which set records for quarterly revenue and profitability, illustrate once again the robust underlying health of our core businesses and the value-enhancing benefits of AD Ports Group’s ‘intelligent’ internationalisation strategy, which under the wise guidance of our leadership in the UAE is driving a prudent, selective global expansion coupled with an emphasis on sustainability. As 2024 comes to a close, there is reason for optimism. While geopolitical disruptions continue to affect visibility, seaborne trade volumes are still expected to grow 2.2% this year, and by 2.0% in 2025, according to Clarkson Research. The global economic situation has developed slightly better than expected this year, and the regional macro environment remains solid, supporting demand and rates for AD Ports Group.”

Martin Aarup, Group Chief Financial Officer, commented:

“Our strong Q3 2024 financial results, in which the Group turned free cash flow positive for the first time on a quarterly basis, provide further corroboration of the accretive growth benefits of our synergistic five-pillar business portfolio, which generated strong growth across the board. The Group recorded a record quarterly EBITDA of AED 1.21 billion in Q3 2024, up 60% year-on-year, and 63% on a like-for-like basis. Our demonstrated restraint on CapEx in Q3 2024, and our near 100% cash conversion rate, are strengths that will continue to drive our profitable growth despite prevailing macroeconomic and geopolitical turbulence.”

Key Business Highlights

- Completed the acquisition of a 60% stake in Tbilisi Dry Port in Georgia.

- Acquisition of a majority stake in Safina, a leading provider of maritime agency and cargo services in Egypt. Safina enjoys a sizeable market share in both Mediterranean and Red Sea Egyptian Ports, including Sokhna, Adabiya, Damietta, Port Said and Alexandria.

- 50-year land lease agreement signed with UAE-based Azizi Developments. Azizi will set up 12 plants spanning across 220,000 sqm, encompassing a reinforcement steel cut and bend facility, timber joinery and duct fabrication workshops, a modular factory, aluminium and glass fabrication units, and an aluminium extrusion factory.

- 50-year land lease agreement signed with UAE-based Abundance Solar Panel Industries. The 27,000 sqm plant will manufacture solar panels and photovoltaic modules to generate clean and renewable energy.

- 50-year land lease agreement signed with UAE-based Apex Engineering Industries. The 40,000 sqm plant will produce industrial parts, components, machinery, and equipment for the oil and gas, defence, and locomotive industries.

- AD Ports Group has been ranked the world’s 19th largest container port operator by Drewry, leveraging its 2023 acquisitions of Spain-based Noatum and Karachi Port container terminal – KGTL. AD Ports Group was also included in the Drewry Port Equity Index, a benchmark global stock index of 10 large publicly traded ports operators.

Container Shipping Market Update and Outlook

- The industry-wide disruptions since December 2023, forcing vessels on the main East-West shipping lane to divert and take longer routes around the Cape of Good Hope, are likely to persist in the short-term.

- Geopolitical tensions in the Middle East, which arguably have been deteriorating since the beginning of the year, have led to continued attacks on ships in the Red Sea / Gulf of Aden, which in turn have resulted in continued global supply chain disruptions.

- Visibility on a normalisation of the situation is still poor.

- Although we are seeing more operators returning to the Red Sea, the resumption of full-scale operations transiting through the Suez Canal is not yet on the horizon. Shipping giants Maersk, Hapag-Lloyd and COSCO have all recently confirmed they will continue to sail around the Cape of Good Hope up until the end of 2024 and into 2025.

- Rates softened in September and October but the following upcoming events could confirm the renewed recent strength: 1) Trump’s win of the US presidential election is likely to lead to US tariff hikes triggering cargo front-loading; 2) re-stocking ahead of next year’s Lunar New Year break, which will start 11 days earlier at the end of January; and 3) fears of a potential re-emergence of US East Coast port strike (mid-Jan 2025), with negotiations on new labour contracts starting later this month. The global economic situation has also been slightly better than expected so far this year and regional macro remains solid supporting demand and rates for AD Ports Group.

- Despite newbuild container ship deliveries being in line with the expected 2.9 million TEUs for this year (+5.7% in global containership fleet during H1 2024) the Red Sea crisis has seen all the new ships being fully employed – vessels rerouting to avoid the Red Sea is estimated to require 10% to 20% additional industry capacity. Fleet renewal is also a way for shipping companies to keep supply-demand dynamics in check.

Ross Thompson, Group Chief Strategy and Growth Officer, said:

“The impressive top- and bottom-line achievements of AD Ports Group in Q3 2024 reflect the underlying resilience of our multi-cluster business structure, which complements and amplifies individual growth opportunities and encourages a level of internal collaboration that enables the Group to convert sudden market disruptions into short-term gains. The record Q3 results at our flagship Khalifa Port, coupled with the contributions from recently acquired businesses in Europe, Egypt and Pakistan, are persuasive examples of our broad-based growth trajectory.”

Financial & Operational Performance by Cluster

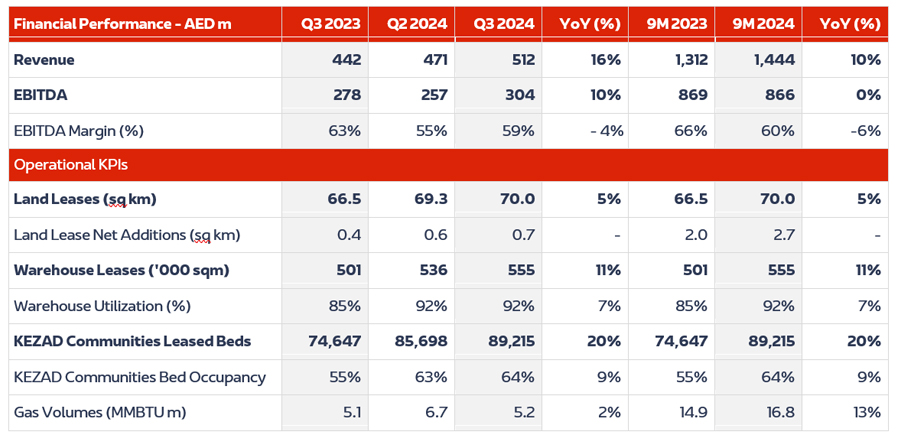

Economic Cities & Free Zones

- Higher warehouse and KEZAD Communities utilization rates YoY despite adding capacity in both business segments in Q3 2024 shows strong demand for these services and were key drivers for the 16% YoY quarterly revenue growth.

- With 0.7 sq km of additional land leases (net) signed during Q3 2024 (2.7 sq km in 9M 2024), AD Ports Group is on track to meet its annual guidance of 3.5-4.0 sq km of land lease net additions.

- Key new leases were in the building materials, oil & gas, and energy sectors.

- Strong top line performance also translated into 10% YoY EBITDA growth, although EBITDA margin has not yet normalised to historical levels of mid-60s due to evolving business mix.

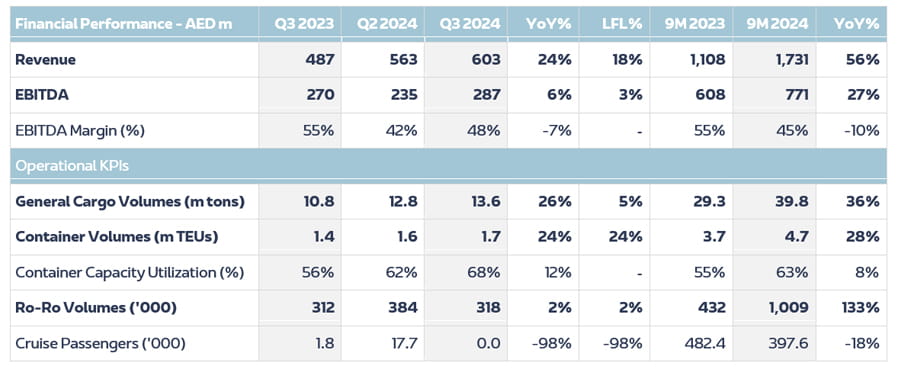

Ports

- Revenue in the Ports Cluster grew 24% YoY in Q3 2024 and 18% YoY on a LFL basis adjusted for the contribution from Karachi Gateway Multipurpose Terminal (KGTML), which has been consolidated since 1st February 2024.

- The strong revenue growth for the cluster was led by strong performance in General Cargo (+42% YoY, driven by revenue mix in the UAE and KGTML in Pakistan), Container Concession fees in the UAE (+49% YoY, including fixed concession fees from CMA Terminals Khalifa Port from July), and international container operations (Spain and Pakistan).

- 22% YoY growth in container throughout at the flagship Khalifa Port in the UAE, which accounted for 87% of total container throughout for the quarter, translating into an all-time high utilization of 76%. Overall container capacity utilization reached 68% for the quarter vs. 56% in Q3 2023.

- The current Red Sea crisis continued to support the quarterly Ro-Ro volumes in Khalifa Port (+53% YoY) while subdued demand in Europe and EV-related trade tensions with China has led to some softening in Ro-Ro volumes in Spain (-11% YoY). Overall, Ro-Ro volumes registered a steady 2% YoY growth for the quarter.

- With strong top line performance and the increasing contribution of container concession fees, EBITDA margin trended back close to the 50% mark.

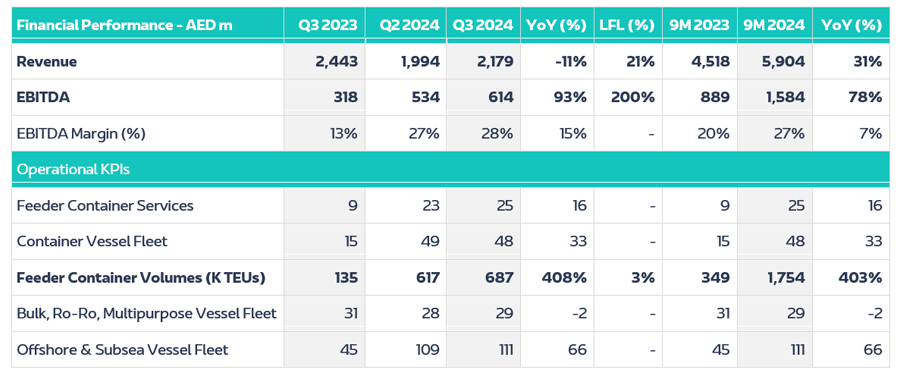

Maritime & Shipping

- Headline revenue for the Maritime & Shipping Cluster declined 11% YoY in Q3 2024, but normalised for the vessel trading activities that took place in Q3 2023, it surged 96% YoY, driven by all key business segments (+148% YoY for Shipping, +85% YoY for Offshore & Subsea, and +23% for Marine Services). On a LFL basis, adjusted for the vessel trading revenue and inorganic effect of GFS, revenue growth remained strong at 21% YoY.

- Container shipping volumes increased more than five-fold YoY to 687K TEUs for the quarter driven by GFS acquisition and higher utilisation.

- The addition of 10 offshore vessels from E-NAV in Q4 2023 was the main reason for the strong revenue performance for the Offshore & Subsea business segment.

- Strong revenue growth in Marine Services was the result of the new dry-docking business coupled with increased activity and traffic at Khalifa Port.

- Favourable shipping market conditions continued to drive up the Cluster’s profitability, with EBITDA margin improving further to 28% in Q3 2024.

- Logistics

- The Logistics Cluster’s strong revenue performance of 48% YoY growth was driven by the Ocean Freight (+73% YoY), Air Freight (+110% YoY), Warehousing (+46% YoY) and Polymer (+52% YoY) businesses together with the acquisition of Sese Auto Logistics, which has been consolidated from 1st February of this year. Adjusted for Sese Auto Logistics acquisition, the Cluster’s revenue grew 42% YoY on a LFL basis.

- The ocean freight market has been going through favourable market conditions, particularly on Asia-to-Europe and Asia-to-Americas routes, pushing rates higher.

- The air freight market continues to grow, driven by strong demand in e-commerce and high-tech components, and benefiting from ongoing disruptions in the ocean freight segment.

- Going forward, capacity constraints in both ocean and air freight are likely to persist due to ongoing geopolitical tensions and supply chain disruptions, keeping rates at elevated levels in the short term.

- In the polymer business, value added services were the primary reason behind the strong revenue performance.

- Strong EBITDA performance was revenue-led, however this was partly offset by Aramex negatively weighing on profitability.

- Digital

- The Digital Cluster’s strong top line growth was driven by services to internal stakeholders and Nishan security services. Adjusted for the consolidation of Dubai Technologies, which started on 1st March 2024, revenue grew 44%YoY on a LFL basis.

- EBITDA performance continued to be impacted by higher provisions and operating expenses, notably in relation to the renewal fees of application licenses.