Drewry: World Container Index down 5% last week

LONDON : For many years, World Container Index has been the go-to, independent, global reference for index-linked contracts. If your organisation is considering index-linked contracts or requires regional visibility/coverage beyond the eight trade lanes provided below, contact our ocean freight cost benchmarking team.

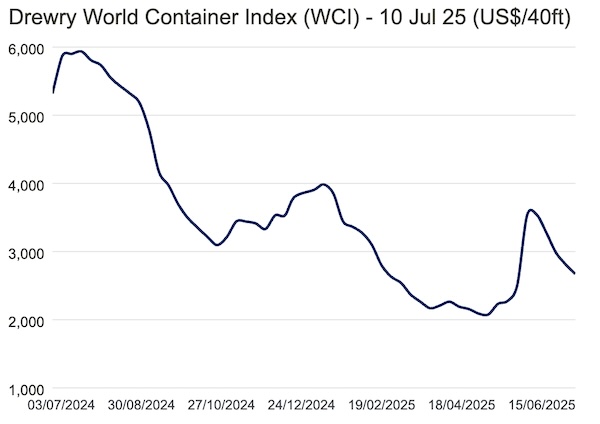

Drewry’s World Container Index decreased 5% to $2,672 per 40ft container this week.

Drewry’s detailed assessment for Thursday, 10 Jul 2025

- Drewry’s WCI Index fell for the fourth consecutive week, by 5% this week. This decline is a direct result of the low demand for US-bound cargo and is a sign that the recent surge in US imports, which occurred after the temporary halt on higher US tariffs, will not have the lasting impact we had initially expected.

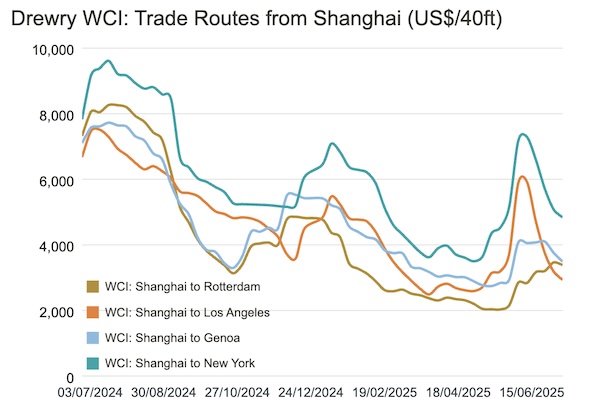

- Freight rates from Shanghai to Los Angeles decreased 8% to $2,931 per 40ft container in the past week, but spot rates are still up a significant 8% compared to nine weeks ago (8 May). Similarly, spot rates from Shanghai to New York dropped 5% this past week to $4,839 per 40ft container, but gained 33% over the last nine weeks. Drewry expects spot rates to continue to decline next week as well due to excess capacity and weak demand.

- Freight rates from Shanghai to Genoa decreased 7% to $3,491 per 40ft container, while those from Shanghai to Rotterdam decreased 2% to $3,384 per 40ft container.

- However, Drewry’s Container Forecaster expects the supply-demand balance to weaken again in 2H25, which will cause spot rates to decline. The volatility and timing of rate changes will depend on Trump’s future tariffs and on capacity changes related to the introduction of the US penalties on Chinese ships, which are uncertain.