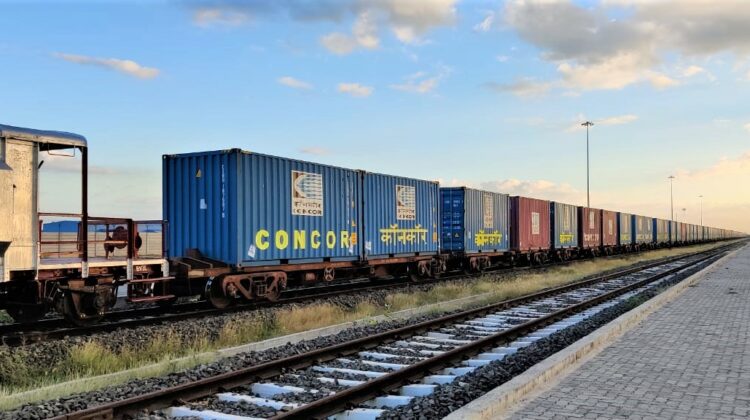

Govt can decide of 5-7% stake sale in CONCOR after tepid response to strategic sale plan

NEW DELHI : The government of India is considering selling five to seven percent of the Container Corp of India (CONCOR) after plans for a strategic sale to privatise the company met with lukewarm interest, government sources said.

The government is understood to be considering options like offer for sale or qualified institutional placement (QIP) for the stake sale.

Multiple government officials said that the central government has decided to put the divestment of CONCOR on hold indefinitely after failing to find potential buyers.

The state-run company’s inability to reduce its land leasing fee and lack of support from the Ministry of Railways may have acted as a deterrent for potential buyers and created a roadblock for the government’s plan to divest around 30.8 percent of its total 54.8 percent stake, they said.

“CONCOR strategic sale is on the back burner. No work towards the strategic sale of CONCOR is on,” a senior government official said.

“If the government really wants to take it ahead, the go-ahead has to come from the top, the govt needs to give an informal go ahead for its strategic sale only then it can be taken further. Now its strategic sale is unlikely in this fiscal at least,” the official added.

The Cabinet in November 2019 had approved the strategic sale of a 30.8 percent stake (out of the government’s equity of 54.80 percent), along with the transfer of management control in CONCOR . The government would have retained a 24 percent stake but without any veto powers. But the plan has moved slowly.

“Concor strategic sale has been stuck for long. Earlier Railway Ministry had some issues with its strategic sale. The land leasing policy was passed so that the Concor strategic sale could have got a push. But it has not happened. A coalition government will also impact the government’s strategic sale decisions as the trade unions are always against it,” the senior government official said on condition of anonymity.

Email inquiries sent to CONCOR and the Department of Investment and Public Asset Management (DIPAM) did not receive a response till the time of publishing. This story will be updated once their response is received.

Plan B for CONCOR

The government is now looking to offload stake in CONCOR in smaller packets and may look to sell a five-seven percent stake in the company and is in discussions with financial institutions for the same, a second government official said.

“CONCOR’s management has been asked to work with financial institutions to gauge interest in the smaller strategic sale of its stake either through an offer for sale, or qualified institutional placement (QIP) route,” the second official said.

Similarly, another government official said that CONCOR has already started working with financial institutions to discuss buying a minority stake and more discussions on the same will continue with the government after the Union Budget for 2024-25.

The government’s decision to sell a smaller stake in the company comes on the back of a significant increase in valuations. Since the government approved the divestment of shares on CONCOR in November 2019, the company’s market capitalisation has increased by 200 percent to Rs 62,470.95 crore.

Based on the company’s current market capitalisation, a five to seven percent stake earmarked for sale is worth around Rs 3,500 crore – Rs 4,700 crore.

Land Licensing Fees Overhang

Furthermore, CONCOR is expected to start the process of switching its inland terminals to the government’s new land-licence fee regime in 2024-25, which is expected to help curb its rising land licensing fees outgo to the government, officials said.

“CONCOR is in discussion to switch two inland container depots to the new land licensing fees (regime) including part of its largest depot at Tughlakabad in New Delhi,” the third official said.

This move is poised to substantially decrease CONCOR’s annual land licence fee (LLF) by approximately Rs 120 crore in 2024-25.

Spread over 195 acres Tughlakhabad is CONCOR’s flagship terminaL

In FY24, CONCOR paid Rs 424 crore as land licence fee to the Ministry of Railways.

CONCOR currently runs 61 inland container depots, of which 26 are on land leased from Indian Railways. These 26 terminals account for more than half of the annual revenue of the company.

Last month, Sanjay Swarup the company’s Chairman and Managing Director said that the country’s largest container freight operator, is looking to raise its overall cargo volumes by 18-20 percent on year in 2024-25, and plans to spend Rs 610 crore in the ongoing financial year on the same.

“In FY 25, we expect growth of 15 percent in EXIM and 25 percent in the domestic segment . This will translate to overall growth of 18-20 percent for CONCOR,” Swarup said in an interview.

The DIPAM had in October 2023 held roadshows to gauge investor interest, and has appointed L&L Partners as the legal advisor for the partial divestment. Deloitte Touche Tohmatsu India has been roped in as transaction advisor and RBSA Valuation Advisors LLP as asset valuer.

In September 2023, the government came out with a new land leasing policy after market participants raised concerns over the land licensing fees being paid by CONCOR.