Ministry of Finance Year End Review 2024: Department of Revenue

NEW DELHI : In the year 2024, the Central Board of Direct Taxes (CBDT) and Central Board of Indirect taxes and Customs (CBIC), under the Department of Revenue, Ministry of Finance, have continued their citizen-centric initiatives, driving significant reforms to enhance taxpayer experience.

The CBDT maintained its focus on taxpayer outreach and assistance through active helpdesks and embraced faceless processes, reinforcing its commitment to transparency and efficiency. Speedy processing of returns and refunds remained a priority, with over Rs. 2.35 lakh crore refunded and more than 3.87 crore Income Tax Returns (ITRs) processed within 7 days. Innovations like TIN 2.0, pre-filling of ITRs, and updated returns continued to streamline processes, resulting in 47.52 lakh updated returns filed.

The CBIC continued to review and reform initiatives towards enhancing the efficiency and integrity of the Goods and Services Tax (GST) system in its seventh year. The CBIC leveraged advanced data analytics and artificial intelligence to further strengthened its registration processes by refining the risk rating system for applicants, ensuring rigorous verification to prevent fraud. Initiatives such as geo-tagging of business locations, system-based suspension of registrations for non-filers, and risk-based refund processing continued to demonstrate CBIC’s commitment to curbing malpractices.

To simplify compliance, the sequential filing of GSTR-1 and GSTR-3B was enforced, promoting timely returns and seamless availability of input tax credits. Special drives against fake registrations, automated intimation of mismatches, and a dedicated functionality for unregistered persons to apply for temporary registrations highlighted CBIC’s proactive compliance measures.

Additionally, initiatives supporting businesses included the transfer of balances in electronic cash ledgers, exemptions for small taxpayers, and facilitation of intra-state supply through e-commerce operators. The extension of GST exemptions for satellite launch services and further simplification of late fee structures were also noteworthy.

On the Customs front, the CBIC introduced regulatory and policy reforms, such as rationalisation of Customs duty rates and steps toward decriminalisation. Technological advancements like ICEGATE 2.0 and the Anonymised Escalation Mechanism continued to modernise tax administration. Infrastructural upgrades, including pre-gate processing facilities and modernisation of control laboratories, enhanced operational efficiency. These efforts collectively reinforced CBIC’s commitment to transparency, Ease of Doing Business, and robust compliance frameworks in the year 2024.

Besides these, the Department of Revenue also continued to contribute towards strengthening financial intelligence gathering and enabling enforcement through multiple measures. One major highlight of the FIU was India achieving a high-level of technical compliance across the Financial Action task Force (FATF) recommendations to tackle illicit finance.

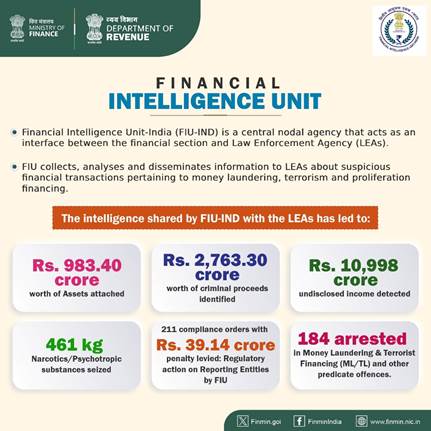

Major achievements of 2024 by Financial Intelligence Unit (FIU) under the Department of Revenue, Ministry of Finance.

- Financial Intelligence Unit-India (FIU-IND) is a central nodal agency that acts as an interface between the financial section and Law Enforcement Agency (LEAs).

- FIU collects, analyses and disseminates information to LEAs about suspicious financial transactions pertaining to money laundering, terrorism and proliferation financing.

The intelligence shared by FIU-IND with the LEAs has led to:

- Rs. 983.40 crore worth of Assets attached

- Rs 2,763.30 crore worth of criminal proceeds identified

- Rs. 10,998 crore undisclosed income detected

- 461 kg Narcotics/Psychotropic substances seized

- 211 compliance orders with Rs 39.14 crore penalty levied: Regulatory action on Reporting Entities by FIU

- 184 arrested in Money Laundering and Terrorist Financing (ML/TL) and other predicate offences.

FATF PLACES INDIA IN ITS HIGHEST CATEGORY

- The Financial Action Task Force (FATF) is the global money laundering and terrorist financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society.

- India has achieved a high-level of technical compliance across the FATF Recommendations and has taken significant steps to implement measures to tackle illicit finance.

- FATF has placed India in its highest category “regular follow-up” after mutual evaluation done during 2023-24.

- It is a distinction shared by only four G20 countries.

- FATF has recognized India’s efforts in mitigating risks from money laundering, terror and proliferation financing.

BROAD ACHIEVEMENTS UNDER THE CENTRAL BOARD OF DIRECT TAXES (CBDT) IN 2024:

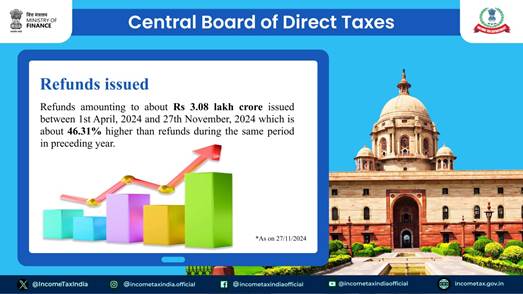

REFUNDS ISSUED

Refunds amounting to about Rs 3.08 lakh crore issued between 1st April, 2024 and 27th November, 2024 which is about 46.31% higher than refunds during the same period in preceding year.

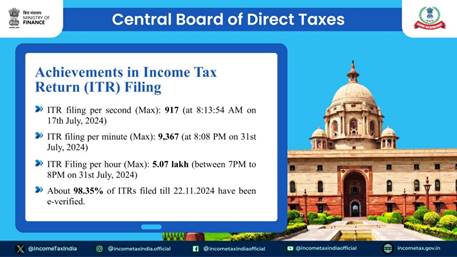

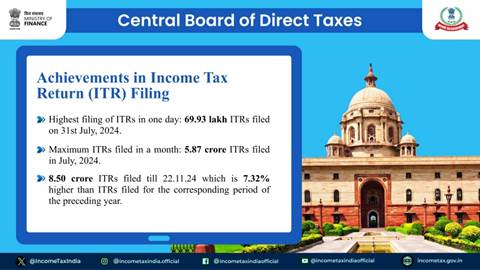

ACHIEVEMENTS IN INCOME TAX RETURN (ITR) FILING

- ITR filing per second (Max): 917 (at 8:13:54 AM on 17th July, 2024)

- ITR filing per minute (Max): 9,367 (at 8:08 PM on 31st July, 2024)

- ITR Filing per hour (Max): 5.07 lakh (between 7PM to 8PM on 31st July, 2024)

- About 98.35% of ITRS filed till 22.11.2024 have been e-verified.

- Highest filing of ITRS in one day: 69.93 lakh ITRS filed on 31st July, 2024.

- Maximum ITRS filed in a month: 5.87 crore ITRS filed in July, 2024.

- 8.50 crore ITRS filed till 22.11.24 which is 7.32% higher than ITRs filed for the corresponding period of the preceding year.

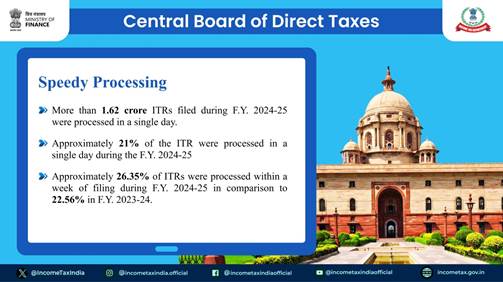

SPEEDY PROCESSING

- More than 1.62 crore ITRS filed during F.Y. 2024-25 were processed in a single day.

- Approximately 21% of the ITR were processed in a single day during the

- F.Y. 2024-25.

- Approximately 26.35% of ITRS were processed within a week of filing during F.Y. 2024-25 in comparison to 22.56% in F.Y. 2023-24.

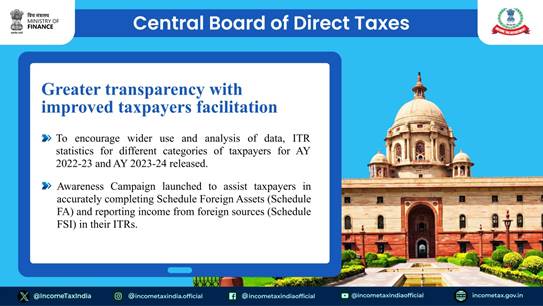

GREATER TRANSPARENCY WITH IMPROVED TAXPAYER FACILITATION

- To encourage wider use and analysis of data, ITR statistics for different categories of taxpayers for AY 2022-23 and AY 2023-24 released.

- Awareness Campaign launched to assist taxpayers in accurately completing Schedule Foreign Assets (Schedule FA) and reporting income from foreign sources (Schedule FSI) in their ITRs.

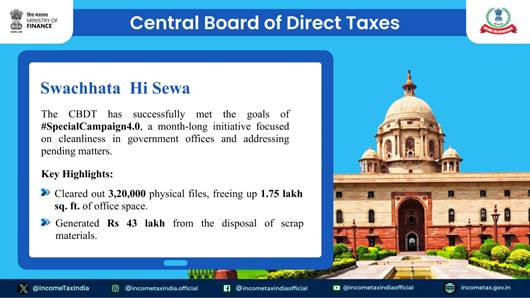

SWACHHATA HI SEWA

The CBDT has successfully met the goals of #SpecialCampaign4.0, a month-long initiative focused on cleanliness in government offices and addressing pending matters.

Key Highlights:

- Cleared out 3,20,000 physical files, freeing up 1.75 lakh sq. ft. of office space.

- Generated Rs 43 lakh from the disposal of scrap materials.

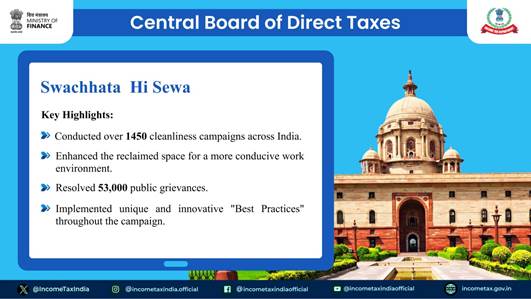

- Conducted over 1450 cleanliness campaigns across India.

- Enhanced the reclaimed space for a more conducive work environment.

- Resolved 53,000 public grievances.

- Implemented unique and innovative “Best Practices” throughout the campaign.

FACILITATION TO THE TAXPAYERS

- The validation introduced at the upload level of the ITRS is another move to nudge or to take relook at the possible inconsistencies and to facilitate correction before filing of the ITRS.

- This resulted in reduction of filing of revised return, rectification request and grievance.

- The ITR forms for A.Y. 2024-2025 with all associated functions were rolled out on 1st April, 2024 on the E- filing portal.

- More than 76 crore emails & SMSS were sent under E- campaign to popularize the EVC mode during the year under consideration.

- As a result 96% of ITR filers adopted the EVC mode for verification of ITRS in A.Y. 2024-25.

ESTABLISHMENT OF DEMAND MANAGEMENT FACILITATION CENTRE (DFC)

- During the period 01.01.24 to 13.10.2024, 1,31,180 number of demands amounting to Rs 5,00,224 cr. have been reduced/resolved.

- The DFC currently consists of 170 agents who work 6 days a week.

- Scheduled calls are made to the tax payers and JAOS for the purpose of resolution of demand.

BROAD ACHIEVEMENTS UNDER THE CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS(CBIC) IN 2024:

GOODS AND SERVICES TAX (GST)

Recent measures for simplification, trade facilitation and Ease of Doing Business under GST:

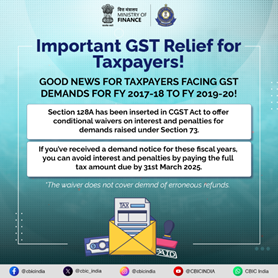

- Insertion of section 128A in CGST Act, 2017 has been carried out to provide for conditional waiver of interest or penalty or both relating to demands raised under Section 73, for FY 2017-18 to FY 2019-20 : Considering the difficulties faced by the taxpayers, during the initial years of implementation of GST, amendments have been made in the CGST Act, to provide for continued waiver of interest and penalties for demand notices issued under Section 73 of the CGST Act for the fiscal years 2017-18, 2018- 19 and 2019-20, in cases where the taxpayer pays the full amount of tax demanded in the notice upto 31.03.2025.

- Reduction of Government Litigation by Fixing monetary limits for filing appeals under GST. The CBIC has issued Circular No. 207/01/2024-GST dated 26.06.2024 to prescribe monetary limits, subject to certain exclusions, for filing of appeals in GST by the department before GST Appellate Tribunal, High Court, and Supreme Court, to reduce government litigation.

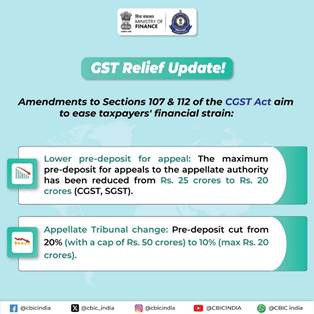

· Amendment in Section 107 and Section 112 of CGST Act for reducing the amount of pre-deposit required to be paid for filing of appeals under GST: Provisions have been made for reducing the amount of pre-deposit for filing of appeals under GST to ease cash flow and working capital blockage for the taxpayers. The maximum amount for filing appeal with the appellate authority has been reduced from Rs. 25 crores CGST and Rs. 25 crores SGST to Rs. 20 crores CGST and Rs. 20 crores SGST. Further, the amount of pre-deposit for filing appeal with the Appellate Tribunal has been reduced from 20% with a maximum amount of Rs. 50 crores CGST and Rs. 50 crores SGST to 10 % with a maximum of Rs. 20 crores CGST and Rs. 20 crores SGST.

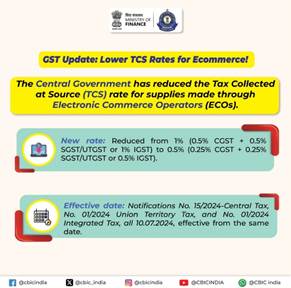

Reduction in rate of TCS to be collected by the ECOs for supplies being made through them: Electronic Commerce Operators (ECOs) are required to collect Tax Collected at Source (TCS) on net taxable supplies under Section 52(1) of the CGST Act. The Central Government has issued Notification No. 15/2024-Central Tax dated 10.07.2024 (notified w.e.f. 10.07.2024), Notification No. 01/2024-Union Territory Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) & Notification No. 01/2024-Integrated Tax dated 10.07.2024 (notified w.e.f. 10.07.2024) to reduce the TCS rate from present 1% (0.5% CGST + 0.5% SGST/ UTGST, or 1% IGST) to 0.5 % (0.25%

CGST + 0.25% SGST/UTGST, or 0.5% IGST), to ease the financial burden on the suppliers making supplies through such ECOs.

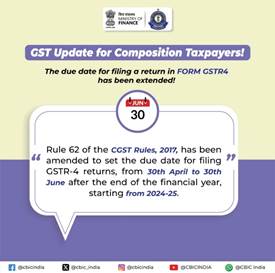

· Change in due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June: Amendments have been done in clause (ii) of sub-rule (1) of Rule 62 of CGST Rules, 2017 and FORM GSTR- 4 to extend the due date for filing of return in FORM GSTR-4 for composition taxpayers from 30th April to 30th June following the end of the financial year. This will apply for returns for the financial year 2024-25 onwards. The same would give more time to the taxpayers who opt to pay tax under composition levy to furnish the said return.

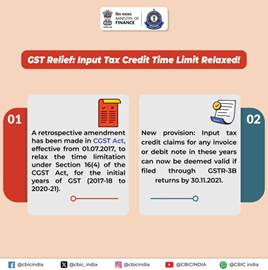

- Amendments of Section 16(4) of CGST Act, to be made effective from July 1st, 2017,to relax condition of section 16(4) of the CGST Act in respect of initial years of implementation of GST, i.e. financial years 2017-18, 2018-19, 2019-20 and 2020-21: Considering the difficulties faced by the taxpayers during the initial years of implementation of GST, based on the recommendations of the GST Council, retrospective amendment has been made in Section 16(4) of CGST Act to relax the time limit to avail input tax credit in respect of any invoice or debit note under Section 16(4) of CGST Act, through any GSTR 3B return filed upto 30.11.2021 for the financial years 2017-18, 2018-19, 2019-20 and 2020-21, may be deemed to be 30.11.2021. This would benefit a large number of taxpayers, especially smaller ones, who could not file returns in a timely manner in the initial years of GST, due to various reasons by which time, the time limit for availment of Input tax credit, under section 16(4) of CGST Act had already expired, which has led to issuance of demands denying them the benefit of input tax credit.

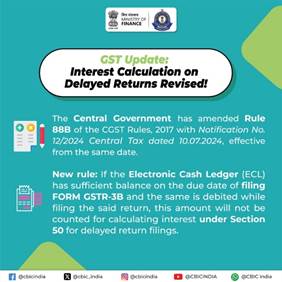

Amendment of Rule 88B of CGST Rules, 2017 in respect of interest under Section 50 of CGST Act on delayed filing of returns, in cases where the credit is available in Electronic Cash Ledger (ECL) on the due date of filing the said return:-The Central Government has issued Notification No. 12/2024-Central Tax dated 10.07.2024 for amendment in rule 88B (w.e.f. 10.07.2024) of CGST Rules to provide that an amount which is available in the Electronic Cash Ledger on the due date of filing of return in FORM GSTR-3B, and is debited while filing the said return, shall not be included while calculating interest under section 50 of the CGST Act in respect of delayed filing of the said return. This will reduce interest burden on such taxpayers.

Provision of new optional facility for taxpayers to amend the details in GSTR-1: The Central Government has provided for a new optional facility by way of FORM GSTR-1A (w.e.f. 10.07.2024) to facilitate the taxpayers to amend the details in FORM GSTR-1 for a tax period and/ or to declare additional details, if any, before filing of return in FORM GSTR-3B for the said tax period. This will facilitate taxpayer to add any particulars of supply of the current tax period missed out in reporting in FORM GSTR-1 of the said tax period or to amend any particulars already declared in FORM GSTR-1 of the current tax period (including those declared in IFF, for the first and second months of a quarter, if any, for quarterly taxpayers), to ensure that correct liability is auto-populated in FORM GSTR-3B.

A consolidated guidelines dated 30.03.2024 were issued to all CGST Zones in respect of Ease of Doing Business (EODB) to be followed during investigations of cases against regular taxpayers

Besides, based on the recommendations of the GST Council, a large number of notifications and circulars have been issued on contentious issues, so as to avoid legal disputes.

RECOMMENDATIONS OF THE 55th GST COUNCIL MEETING

- GST Council recommended reduction in GST rate on Fortified Rice Kernel (FRK), classifiable under 1904, to 5% .

- GST council also recommended to fully exempt GST on gene therapy.

- GST Council recommended exemption of GST on contributions by general insurance companies from third-party motor vehicle premiums for Motor Vehicle Accident Fund.

- GST Council recommended no GST on transaction of vouchers as they are neither supply of goods nor supply of services. The provisions related to vouchers is also being simplified.

- GST Council clarified that no GST is payable on ‘penal charges’ levied and collected by banks and NBFCs from borrowers for non-compliance with loan terms.

- GST Council recommended reduction of payment of pre-deposit for filing an appeal before the Appellate Authority in respect of an order passed which involves only penalty amount.

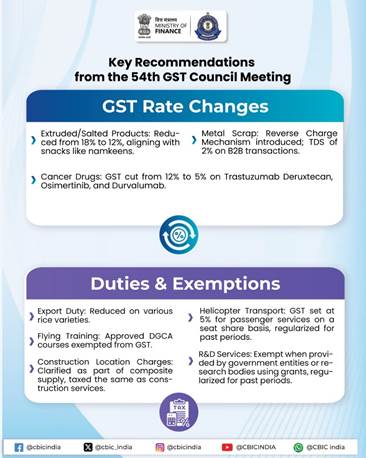

RECOMMENDATIONS OF THE 54thGST COUNCIL MEETING

Recommendations Relating to GST Rates on Goods:

- GST rate on extruded or expanded products, salted or savoury, reduced from 18% to 12%, aligning them with GST rate on namkeens, bhujia, mixture, and similar ready-to-consume items.

- GST rate on cancer drugs such as Trastuzumab Deruxtecan, Osimertinib, and Durvalumab reduced from 12% to 5%.

- Reverse Charge Mechanism introduced on the supply of metal scrap by unregistered persons to registered persons. A Tax Deducted at Source (TDS) of 2% applies to B2B supply of metal scrap by registered persons.

Duties & Exemptions

- Export duty on various varieties of rice has been reduced.

- A Group of Ministers (GoM) has been constituted to holistically look into the issues pertaining to GST on the life insurance and health insurance.

- It has been recommended to notify GST @ 5% on the transport of passengers by helicopters on seat share basis and also to regularise the GST for past period on ‘as is where is’ basis.

- It has been recommended to clarify by way of a circular that the approved flying training courses conducted by DGCA approved Flying Training Organizations (FTOs) are exempt from the levy of GST.

- It has been recommended to exempt supply of research and development services by a Government Entity; or a research association, university, college or other institution, notified under clauses (ii) or (iii) of sub-section (1) of section 35 of the Income Tax Act, 1961 using Government or private grants. It has also been recommended to regularize past demands on ‘as is where is’ basis.

- It has been recommended to clarify that location charges or Preferential Location Charges (PLC) paid along with the consideration for the construction services of residential/commercial/industrial complex before issuance of completion certificate forms part of composite supply where supply of construction services is the main service and PLC is naturally bundled with it and are eligible for same tax treatment as the main supply that is, construction service.

- It has been recommended to clarify that affiliation services provided by educational boards like CBSE are taxable. It has also been recommended to exempt affiliation services provided by State/Central educational boards, educational councils and other similarly placed bodies to Government Schools prospectively. The issue for the past period between 01.07.2017 to 17.06.2021 is recommended to be regularized on ‘as is where is’ basis.

- It has been recommended to clarify by way of circular that the affiliation services provided by universities to their constituent colleges are not covered within the ambit of exemptions provided to educational institutions in the notification No. 12/2017-CT(R) dated 28.06.2017 and GST at the rate of 18% is applicable on the affiliation services provided by the universities.

- It has been recommended to exempt import of services by an establishment of a foreign airlines company from a related person or any of its establishment outside India, when made without consideration. The council also recommended to regularise the past period on ‘as is where is’ basis.

- It has been recommended to bring renting of commercial property by unregistered person to a registered person under Reverse Charge Mechanism (RCM) to prevent revenue leakage.

- It has been recommended to clarify that when ancillary/intermediate services are provided by GTA in the course of transportation of goods by road and GTA also issues consignment note, the service will constitute a composite supply and all such ancillary/intermediate services like loading/unloading, packing/unpacking, transshipment, temporary warehousing etc. will be treated as part of the composite supply. If such services are not provided in the course of transportation of goods and invoiced separately, then these services will not be treated as composite supply of transport of goods.

- It has been recommended to regularise the GST liability for the past period prior to 01.10.2021 on ‘as is where is’ basis, where the film distributor or sub- distributor acts on a principal basis to acquire and distribute films.

- It has been recommended to exempt supply of services such as application fees for providing electricity connection, rental charges against electricity meter, testing fees for meters/ transformers/capacitors, labour charges from customers for shifting of meters/service lines, charges for duplicate bills etc. which are incidental, ancillary or integral to the supply of transmission and distribution of electricity by transmission and distribution utilities to their consumers, when provided as a composite supply. It has also been recommended to regularize GST for the past period on ‘as is where is’ basis.

RECOMMENDATIONS OF THE 53rd GST COUNCIL MEETING

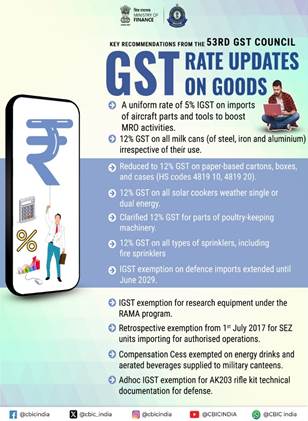

Recommendations Relating to GST Rates on Goods

- Uniform Integrated GST (IGST) rate of 5% on imports of parts, components, testing equipment, tools, and tool-kits of aircraft, regardless of their HS classification to stimulate Maintenance, Repair, and Overhaul (MRO) activities in the aviation sector, subject to specified conditions.

- All milk cans made of steel, iron, or aluminium will attract a GST rate of 12%, irrespective of their intended use.

- The GST rate on cartons, boxes, and cases made of both corrugated and non-corrugated paper or paperboard (HS codes 4819 10 and 4819 20) has been reduced from 18% to 12%.

- solar cookers, whether single or dual energy source, will attract a GST rate of 12%.

- The existing entry covering poultry keeping machinery attracting 12% GST has been amended to specifically include “parts of poultry keeping machinery,” regularizing past practices due to interpretational issues.

- All types of sprinklers, including fire water sprinklers, will attract a GST rate of 12%, and past practices will be regularized.

- IGST exemption on imports of specified items for defense forces has been extended for an additional five years until 30th June 2029.

- IGST exemption has been extended to imports of research equipment and buoys under the Research Moored Array for African-Asian-Australian Monsoon Analysis and Prediction (RAMA) programme, subject to specified conditions.

- Compensation Cess on imports into Special Economic Zones (SEZ) by SEZ units or developers for authorized operations is exempted retrospectively from 1st July 2017.

- Compensation Cess is exempted on the supply of aerated beverages and energy drinks to authorized customers by Unit Run Canteens under the Ministry of Defense.

- An ad-hoc IGST exemption is provided on imports of technical documentation for AK-203 rifle kits imported for the Indian Defense forces.

Measures for Facilitation of Trade

- Section 9(1) of the CGST Act, 2017, is amended to explicitly exclude rectified spirit or ENA from the scope of GST when supplied for manufacturing alcoholic liquor for human consumption.

- Services provided by Indian Railways to general public, namely, sale of platform tickets, facility of retiring rooms/waiting rooms, cloak room services and battery-operated car services and Intra-Railway transactions have been exempted [vide Notification No. 04/2024-CTR dated 12.07.2024 w.e.f., 15.07.2024]. The issue for the past period has also been regularized [Circular No. 228/22/2024-GST dated 15.07.2024].

- Services provided by Special Purpose Vehicles (SPV) to Indian Railway by way of allowing Indian Railway to use infrastructure built & owned by SPV during the concession period and maintenance services supplied by Indian Railways to SPV have been exempted [vide Notification No. 04/2024-CTR dated 12.07.2024 w.e.f., 15.07.2024]. The issue for the past has also been [Circular No. 228/22/2024-GST dated 15.07.2024];

- A separate entry has been created in notification No. 12/2017- CTR 28.06.2017 under heading 9963 to exempt accommodation services having value of supply of accommodation up to Rs. 20,000/- per month per person subject to the condition that the accommodation service is supplied for a minimum continuous period of 90 days [vide Notification No. 04/2024-CTR dated 12.07.2024 w.e.f., 15.07.2024]. Similar benefit has been extended for past cases [Circular No. 228/22/2024-GST dated 15.07.2024];

- Co-insurance premium apportioned by lead insurer to the co-insurer for the supply of insurance service by lead and co-insurer to the insured in coinsurance agreements, has been declared as no supply under Schedule III of the CGST Act, 2017 and past cases have been regularized on ‘as is where is’ basis [Circular No. 228/22/2024-GST dated 15.07.2024].

- Transaction of ceding commission/re-insurance commission between insurer and re-insurer has been declared as no supply under Schedule III of CGST Act, 2017 and past cases have been regularized on ‘as is where is’ basis [Circular No. 228/22/2024-GST dated 15.07.2024].

- GST liability on reinsurance services of specified insurance schemes covered by Sr. Nos. 35 & 36 of notification No. 12/2017-CT (Rate) dated 28.06.2017 have been regularized on ‘as is where is’ basis for the period from 01.07.2017 to 24.01.2018 [Circular No. 228/22/2024-GST dated 15.07.2024].

- GST liability on reinsurance services of the insurance schemes for which total premium is paid by the Government that are covered under Sr. No. 40 of notification No. 12/2017-CTR dated 28.06.2017 have been regularized on ‘as is where is’ basis for the period from 01.07.2017 to 26.07.2018 [Circular No. 228/22/2024-GST dated 15.07.2024].

- Clarification has been issued that retrocession is ‘re-insurance of re- insurance’ and therefore, eligible for the exemption under Sl. No. 36A of the notification No. 12/2017-CTR dated 28.06.2017 [Circular No. 228/22/2024- GST dated 15.07.2024].

- Clarification has been issued that statutory collections made by Real Estate Regulatory Authority (RERA) are exempt from GST as they fall within the scope of entry 4 of No.12/2017-CTR dated 28.06.2017 [Circular No. 228/22/2024-GST dated 15.07.2024].

- Clarification has been issued that further sharing of the incentive by acquiring bank with other stakeholders, where the sharing of such incentive is clearly defined under Incentive scheme for promotion of RuPay Debit Cards and low value BHIM-UPI transactions and is decided in the proportion and manner by NPCI in consultation with the participating banks is not taxable [Circular No. 228/22/2024-GST dated 15.07.2024].

CUSTOMS

Budget 2024-25- major announcements:

- Basic Customs Duty (BCD) on shea nuts reduced from 30% to 15%.

- BCD reduced to nil on critical minerals such as Antimony, Beryllium, Bismuth, Cobalt, Copper, Gallium, Germanium, and others. BCD reduced to 2.5% on minerals like Graphite, Silicon Quartz, and Silicon Dioxide.

- BCD on prawn and shrimp feed and fish feed reduced to 5%. BCD on live Specific Pathogen Free (SPF) Vannamei shrimp and Black Tiger shrimp broodstock reduced to 5%. BCD reduced on various inputs like mineral and vitamin premixes, krill meal, fish lipid oil, and others, subject to IGCR conditions.

- BCD increased on ammonium nitrate from 7.5% to 10%.

- BCD on PVC flex films increased to 25%.

- Customs duty exempted on cancer drugs-Trastuzumab Deruxtecan, Osimertinib, and Durvalumab.

Issuance of Instruction No. 06/2024-Customs dt. 23.03.24

· Smooth and fair elections require coordinated and focused attention, including proper sharing of information by various LEA’s. To this effect, vide Instructions No. 06/2024-Customs dt. 23.03.24 a detailed Standard Operating Procedure was issued for all formations under CBIC to curb the flow of suspicious cash, illicit liquor, drugs/narcotics, freebies and smuggled goods during elections. It includes instructions regarding reporting of major seizures (more than Rs.1 crore) during election & implementation of ESMS for reporting interceptions/seizures made by various enforcement agencies on real-time basis.

Handing over of Antiquities seized by Customs to ASI

- Consequent to repatriation of a 16th century stolen idol of Maa Kotrakshi, in presence of Hon’ble Minister of Education and Skill Development & Entrepreneurship; a project for handing over of antiquities seized pan India by Customs to ASI was undertaken. A handing over ceremony was organized on 29.02.2024 chaired by the Hon’ble Finance Minister and 101 such antiquities were handed over to ASI. A handbook titled ‘Puravshesh ke Prahari’ describing the historical importance of these antiquities and role of Customs in preserving our cultural heritage was also released on the occasion.

- DGFT extended the RoDTEP Scheme to include good exported from EOU and SEZ sector. To give effect to this, CBIC issued notification nos. 20/2024- Customs (NT) dated 11.03.2024 and 50/2024 -Customs (N.T.) dated 19.07.2024, respectively.

- Notification No. 33/2024-Customs (N.T.) dated 30.04.2024. was issued for amendment in Notification No. 77/2023-Customs (N.T.) dated 20.10.2023 relating to All Industry Rates (AIRs) of Duty Drawback including defence goods.

- Circular No. 04/2024-Customs dated 07.05.2024 was issued regarding changes made in All Industry Rates (AIRs) of duty Drawback notified vide Notification No77/2023-Customs (N.T.) dated 20.10.2023 and 33/2024- Customs (N.T.) dated30.04.2024.

- For disbursal of All Industry Rates (AIR) of duty drawback, CBIC has moved from manually issued physical Cheque (to the nodal bank) based process to end-to-end automated PFMS based disbursal of duty drawback amount directly to exporter’s bank accounts since 05.06.2024. For this CBIC issued Instruction No.15/2024-Customs dated 29.05.2024. This paperless functionality is expected to expedite credit of AIR of drawback amount to exporters’ accounts and increase transparency.

- Notification No. 55/2024-Customs (N.T.) on August 23.08.2024, was issued for revising the All-Industry Rates (AIR) of duty drawback for gold and silver jewellery and articles of silver. This notification amends the earlier Notification No. 77/2023-Customs (N.T.) dated October 20, 2023.

- Drawback Division of CBIC assisted the RoDTEP Committee-2023 for reviewing RoDTEP Rates for various eligible goods, including defence goods, for exports from DTA, AA, EOU & SEZ units. Based on Committee’s recommendations, revised RODTEP rates have been notified by DOC effective from 10.10.2024.

- Indian Customs has always been at the forefront when it comes to adopting cutting edge technology for providing better services. In this regard, Board has launched the Exchange Rate Automation Module and the modalities has been explained in Circular 07/2024-Cus dated 25.06.2024. The exchange rates shall be published on ICEGATE website at 6:00 p.m. twice a month (i.e. 1st & 3rd Thursdays of every month) and shall be accessible for public viewing on ICEGATE website. Thus, the automated system has now replaced the manual process of publication of exchange rates.

- CBIC vide Notification No. 60/2024-Customs (NT) dated 12.09.2024 amended the Courier Imports and Exports (Electronic Declaration and Processing) Regulations, 2010 to allow export incentives viz. Drawback,

- RoDTEP (Remission of Duties and Taxes on Exported Products), RoSCTL (Rebate of State and Central Levies and Taxes) to exports through Courier. Circular No. 15/2024-Customs dated 12.09.2024 explaining the said amendments and informing the stakeholders about extending the export benefits to courier exports has also been issued.

- CBIC and the Department of Posts (DoP) have jointly developed a “hub and spoke” system to facilitate export through postal route. The system leverages digital technology and the vast postal network for creating a paperless, contactless and intermediary-free environment for enhancing exports through postal mode. In continuation of the already authorized 1001 booking post offices, CBIC vide Circular No. 01/2024 dated 01.02.2024 has further authorized an additional 14 booking post offices taking the total number of booking post offices covered under the automated system to a total of 1015. Further, the project for automation of IGST refund on postal exports made using the DNK portal has been implemented with effect from 17th September, 2024.

- Agreement between the Government of the Republic of India and the Government of the Republic of Madagascar on Cooperation and Mutual Administrative Assistance in Customs Matters signed on 27.06.2024 on the side-lines of WCO Council Meeting in Brussels.

- Agreement between the Government of the Republic of India and the Government of the Republic of Belarus on Cooperation and Mutual Assistance in Customs Matters was signed on 28.06.2024 on the side-lines of WCO Council Meeting in Brussels.

- MoU between the CBIC and General Department of Viet Nam Customs on Capacity Building was signed on 31.07.2024

- Cooperative Arrangement between the Central Board of Indirect Taxes and Customs of the Government of the Republic of India and the New Zealand Customs Service in Customs Matter was signed on 06.08.2024

- For providing connectivity to landlocked developing country Bhutan, CBIC in February this year-2024 has issued a Standard Operating Procedure allowing transit of goods between Bhutan and Bangladesh using riverine route through India with the entry/exit points at Jogighopa and Pandu ports in Assam.

- CBIC hosted the 5th Joint Group of Customs Meeting between India & Bhutan from 6th -7th May, 2024 in Leh, India.

- Circular No. 09/2024-Customs dated 09.07.2024 has been issued amending circular No. 29/2020- Customs dated 22.6.2020 for allowing transshipment of Bangladesh export cargo to third Countries through Air Cargo Complex, Kempegowda International Airport Bengaluru.

- Recently, CBIC lead Capacity Building Program on “Advancing Bhutan-India Trade and Economic, Partnership” at Thimpu, Phuentsholing, Gelephu and Samdrup from 29th July- 01st August, 2024.

- 4th National Conference on the Functioning of Land Customs Stations (LCSs) was organized on 28th and 29th August, 2024.

- Circular No. 19/2024-Customs dated 30.09.2024 has been issued regarding Digitization of Customs Bonded Warehouse Procedures relating to obtaining Warehouse license, Bond to Bond Movement of Warehoused goods, and uploading of Monthly Returns.

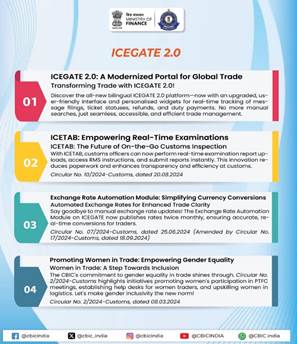

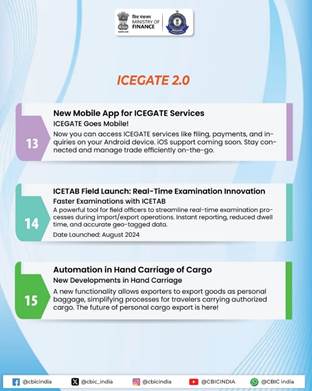

Indian Customs Electronic Commerce/Electronic Data Interchange (ICEGATE) 2.0:

- ICEGATE 2.0 website is a complete bilingual website which has been designed to provide contemporary user interface for enhanced user experience. New feature “widget” is also being provided to show important information such as Message filing status, details of tickets, refunds, and duty payments etc. in personalised dashboard without going for enquiries. Data available in the widgets is also downloadable. Customized notifications facility is being provided to the registered users to choose the events for which they want to receive notifications. Registered users can file their documents themselves using online Web forms on ICEGATE as well which is advancement from earlier offline webforms.

USE of ICETABs for efficient examination and clearance process:

- The ICETAB is part of the CBIC’s ongoing initiatives to simplify trade procedures. The ICETAB is a mobile tablet designed to facilitate the quick and real-time upload of examination reports, enabling Customs Officers to enhance efficiency while on the go. The ICETAB has an exclusive Mobile Application to enable examining officers to view RMS Instructions, Examination Order and Bill of Entry (BE) details along with other supporting documents, capture images of cargo examination for integration with the Bill of Entry and submit examination report immediately on completion of the cargo examination. The ICETAB by Customs Officers is aimed at enhancing transparency and efficiency in customs processes for speedy examination of import consignments with capability to attach photographs with geo- referencing and no requirement for any paper documents for the purpose of examination. This will also facilitate quick upload of the examination report on the go in real time basis and making the examination process transparent and faster. The detailed guidelines for the use of ICETAB are outlined in CBIC Circular No. 10/2024-Customs dated 20.08.2024.

Exchange Rate Automation Module:

· Indian Customs has always been at the forefront when it comes to adopting cutting edge technology for providing better services. In this regard, Board has launched the Exchange Rate Automation Module and the modalities has been explained in Circular 07/2024-Customs dated 25.06.2024 and its amendment Circular No. 17/2024-Customs dated 18.09.2024. The exchange rates shall be published on ICEGATE website at 6:00 p.m. twice a month (i.e. 1st & 3rd Thursdays of every month) and shall be accessible for public viewing on ICEGATE website. Thus, the automated system has now replaced the manual process of publication of exchange rates.

Encouraging Women participation in International Trade:

The Zones have been instructed by the Board Circular No. 2/2024-Customs, dated March 8, 2024 to promote women’s representation and support within customs and trade activities by:

- ensuring women’s representation in PTFC and CCFC meetings, preferably through women’s associations; ensuring women’s representation in PTFC and CCFC meetings, preferably through women’s associations;

- including at least one agenda point from women perspective;

- encouraging Trade bodies/ custodians to establish dedicated help desks and processing mechanisms for women traders and women logistics service providers;

- supporting the upskilling women logistics service providers, freight forwarders and custom brokers by offering relevant trainings for women.

This initiative highlights the importance of gender equality in trade (be it as traders, customs house agents, freight forwarders, or customs brokers) advocating for active efforts from Partner Government Agencies and trade bodies to support the increasing participation of women across various roles in the logistics sector. The detailed guidelines for encouraging Women participation in International Trade are outlined in CBIC Circular No. 2/2024-Customs dated 08.03.2024.

Mandatory additional qualifiers in import/export declarations in respect of Synthetic or Reconstructed Diamonds w.e.f., 01.12.2024:

- As per the Bill of Entry (Electronic Integrated Declaration and Paperless Processing) Regulations, 2018 and Shipping Bill (Electronic Integrated Declaration and Paperless Processing) Regulations, 2019, it will be mandatory to be declare additional qualifiers/identifiers for Lab Grown Diamond at the time of filing of import/export declarations with effect from 01.12.2024. Declaration of additional qualifiers would improve quality of assessment and streamline intervention and enhance facilitation. The detailed instructions in this regard are outlined in CBIC Circular No. 21/2024-Customs dated 30.10.2024.

Extended export related benefits for exports made through courier mode:

- Until now, the Express Cargo Clearance System (ECCS) was used for handling courier import and export shipments at the notified International Courier Terminals (ICTs). However, due to limitations in the system’s architecture, certain export- related payments, such as Duty Drawback, RoDTEP, and RoSCTL, could not be processed through ECCS. To address this issue, it has been decided to implement the Indian Customs EDI System (ICES) at the International Courier Terminals for processing these payments, effective from 12.09.2024. The modalities for this implementation have been outlined in Circular No. 15/2024-Customs, dated 12.09.2024.

Disbursal of Drawback amounts into the exporters’ account through PFMS:

- With effect from 5h June, 2024; payment of Drawback amounts into the exporters’ accounts post scroll out, will be facilitated through the Public Finance Management System (PFMS). The scrolls generated at different locations will be automatically processed by the Customs automated system (CAS) for onward transmission to the Central Nodal e-DDO and the nominated central nodal e-DDO shall forward the consolidated scroll to the nodal e-PAO. After approval from the nodal e-PAO, duty drawback amounts shall be credited into the exporters’ bank accounts linked with PFMS. The detailed instructions have been issued through Instruction No. 15/2024-Customs dated 29.05.2024.

Digitization of Customs Bonded Warehouse procedures relating to obtaining Warehouse License, Bond to Bond Movement of warehoused goods, and uploading of Monthly Returns:

- The CBIC has launched a Warehouse Module on ICEGATE for Customs Bonded Warehouses, enabling: (i) online filing of applications for obtaining a Warehouse License; (ii) online submission and processing of requests to transfer warehoused goods to another person and/ or warehouse; and (iii) uploading Monthly returns for Customs Bonded Warehouses. The Directorate General of Systems (DG Systems) has issued comprehensive User Manuals for both trade members and departmental officers. Detailed procedures are outlined in Circular No. 19/2024- Customs, dated 30.09.2024.

Performance of ongoing schemes/ programs:

- India’s overall trade facilitation score in the Global Survey on Digital and Sustainable Trade Facilitation conducted by the UNESCAP, 2023, increased from 78.49% in 2019 to 93.55% in 2023, indicating a marked improvement in the efficiency of cross-border trade procedures. (Source: CBIC Circular No. 10/2024- Customs dated 20.08.2024)

- India’s Score in UN Trade Facilitation survey on “women in Trade Facilitation” has increased from 0% in 2019 to 66% in 2021 and this has resulted in overall improvement in India ranking in UN Trade Facilitation survey.

Provisioning services to SEZ Units at ICEGATE:

- EDI Enablement of SEZ Sites was successfully completed. Some key services like Registration of SEZ Users, Child User Registration, Amendment in Registration, filing services, Inter and Intra Goods Movement, DTA Procurement, ETP Webform and facilitating DSC Amendment for SEZ users were provisioned for the SEZ users at ICEGATE.

Launch of module for SCMTR (Sea Cargo Manifest and Transhipment Regulations):

The SCMTR also specifies changes to the formats and timelines for filing manifest declarations. Some of the features of the SCMTR include:

- Requesting additional details about each cargo, such as the invoice value and HSN

- Advancing the time of reporting to the port of departure Ensuring track and trace of reported cargo

- Including features for moving vessels within India

- Capturing details electronically, such as crew lists, instead of manually.

Document Download Utility:

- A utility developed at ICEGATE to allow users to download various documents like BE, SB, LEO, OOC, Gatepass for OOC, Gatepass for LEO in the e-Copy functionality at ICEGATE.

Revamp of ICEGATE 2.0 Website:

- ICEGATE website was made more informative and user- friendly.

AI-based interactive Chatbot (Vaani):

- This has been launched for trade at the ICEGATE website to help users with information to access various services of ICEGATE.

Exchange Rate Automation Module:

- A module was launched to automate the integration of Exchange Rates of various Currency codes used in the Customs System. This involved API based integration with SBI to receive the Exchange Rates of the currency codes. These rates are automatically updated on the website as well as the application for the purpose of trade without any manual intervention.

Tracking the details of NOC/Release Order Issuance details from the PGAs

- A facility has been enabled on the dashboard of the users to provide the tracking details of the NOC/Release Order issued by the respective PGA (FSSAI, AQCS and PQMS) on the ICEGATE website against the Bill of entry filed by the user.

API integration with Custodians (Sea and Land):

- The existing MFTP based integration was migrated to API based integration with CONCOR and Adani Land and Sea Ports respectively. This has facilitated the exchange of data between ICEGATE application and Custodians to share the data on a real time basis.

Integration with Department of Post:

- There has been an integration with Department of Post to claim IGST refund for the concerned Shipping Bills filed and claim other export benefits.

IGST Refund for Export through Dak Niryat Kendra (DNK):

- A module has been launched on ICEGATE to enable IGST Refund for export through Dak Niryat Kendra (DNK).

Integration with ECCS for SB filing, Custodian Registration and Message Exchange with ICEGATE:

- There has been an integration with ECCS to claim various export benefits against the Shipping Bills filed.

Export benefits (RoDTEP, RoSCTL & Drawback) to goods exports through Courier mode:

- Export benefits (RoDTEP, RoSCTL& Drawback) extended for exports through the Courier mode.

Warehouse Licensing Code, Warehouse to warehouse goods movement and digitizing the monthly return for warehouse:

- A module has been launched on ICEGATE to provision the generation of Warehouse Licensing Code for Warehouse users. This module also facilitates the goods movement from warehouse to warehouse. There is also a facility to digitize the filing of monthly returns for Warehouse.

Launch of Mobile Application for Internal and External Users over Android Platform:

- Services of ICEGATE like Filing, e-Payment, accessing various enquiries over Android based mobile have been launched. This will soon be available on iOS platform.

- Migration of critical functionalities like Integration with eSeal Vendors, eScrip, Customs E- payment Platform, Integration with DGFT, Examination Module, Integration with GSTN, Container Scanning Module from ICEGATE 1.0 to ICEGATE 2.0. The former being based on legacy-based architecture was migrated to a micro services-based architecture.

Integration with FSSAI, PQMS, AQCS under Single Sign On services:

- A facility has been provided to the registered users to access the respective portal of the agencies like FSSAI, AQCS and PQMS from the ICEGATE website without any login at the respective PGA portal. This will be made live with other PGAs as well in the future.

Integration with BIS:

- API based integration between BIS and ICEGATE to share the license details of the manufacturer for reference to the officer.

Integration with DGFT for RCMC details:

- API based integration between DGFT and ICEGATE to share the RCMC details of the user from DGFT. These details are shown to the user on the dashboard at ICEGATE.

Export benefits to courier

- Export incentives (Drawback, RoDTEP, RoSCTL) to the exports of goods where the value of consignment is less than rupees 10 lakh made through courier and in order to claim export incentives, for e-commerce shipments through ICT, shipping bill would be filed at ICEGATE/ICES.

- Scroll will be generated automatically and there would be no manual intervention.

- The scrips will be generated at ICEGATE portal.

IGST Refund for DAK Niryat

- A mechanism for refund of IGST on exports through post is developed, wherein, the exporters will provide the details for seeking IGST refund at the time of filing postal bill of exports, and such details shall be pushed to the ICES System after physical export of goods, for GST verification with GSTN, and for preparation of scrolls.

- The IGST refunds would be processed in a manner similar to that being done for exports through courier/ ECCS.

Post EGM Amendment Module

- A functionality for allowing the officer to amend the shipping bill after filing of EGM has been developed. Once a shipping bill is amended, the export incentives would be processed again and the benefits would be paid to the exporter as per the existing functionalities.

Hand carriage of cargo

- A functionality is being developed after which an exporter can export goods to be carried by foreign bound passengers authorized by the exporter in his behalf as personal baggage.

ICETAB

- Access to examinee officer to ICES at examination shed Instant report submission in Realtime

- Reduction in dwell time

- Help in storing date and time of picture including Latitude and Longitude of place where picture taken

- Access to RMS instruction, e-Sanchit, BE details at examination shed.

Newly launched development

- Launch of ICETAB for field officers for doing faster examination at the time of Export/Import in August 2024.

- Provisioning of exports benefits (RoDTEP, RoSCTL and Drawback) to commercial exports being processed through the integrated Courier Terminals (ICT) launched on 13.09.2024.

- IGST refund for exports through Dak Niryat Kendras (DNK) rolled out on 17.09.2024.

- 4. 273 SEZ sites launched in ICES on 01.07.2024.

Upcoming development

- Amendment in a shipping bill Post EGM.

- Hand carriage of Cargo (New automation of manual process)