LNG-fuelled vessel orders are growing

The LNG-fuelled vessel order book continues to build this year with 21 ships booked in July, which is currently the monthly average for orders to date this year, according to DNV.

If this level of monthly orders continues it would result in an order book of 250 vessels for 2021. According to the alternative fuels insight (AFI) platform, there are now 213 LNG-fuelled vessels in operation and 350 on order.

Furthermore, 199 vessels are “LNG-ready” while it is also noted that four methanol-fuelled vessels were booked in July, bringing the total in operation and on order to 30.

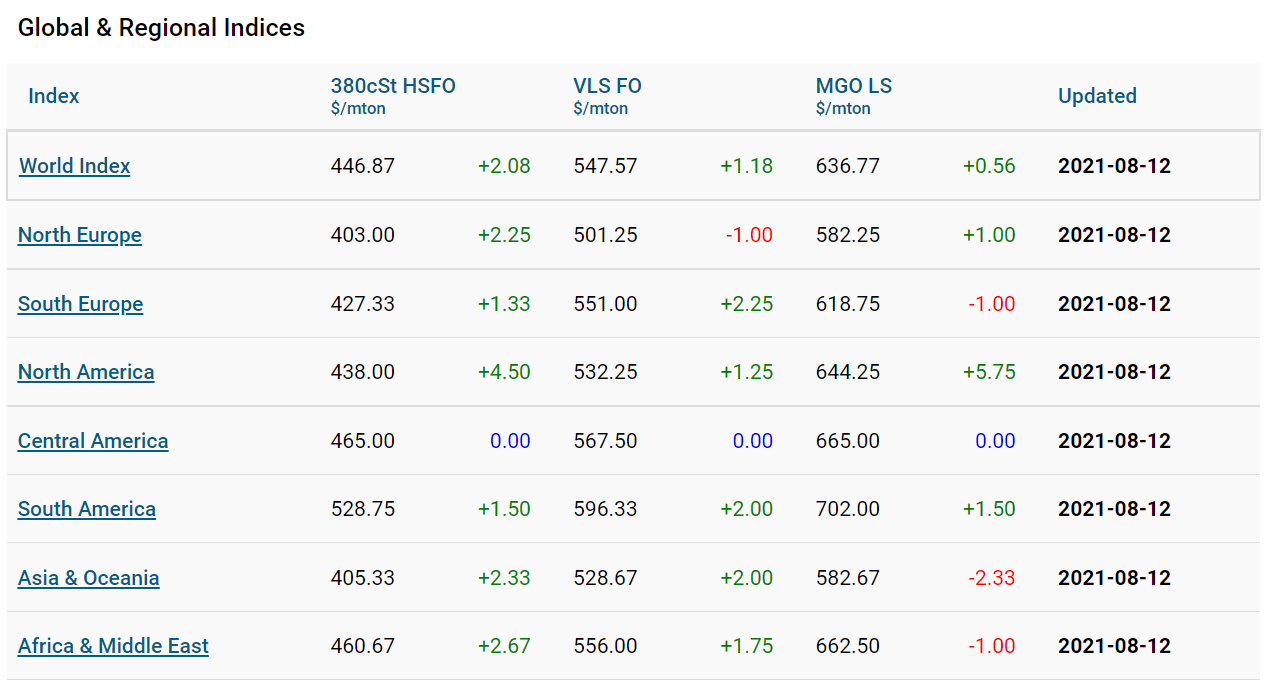

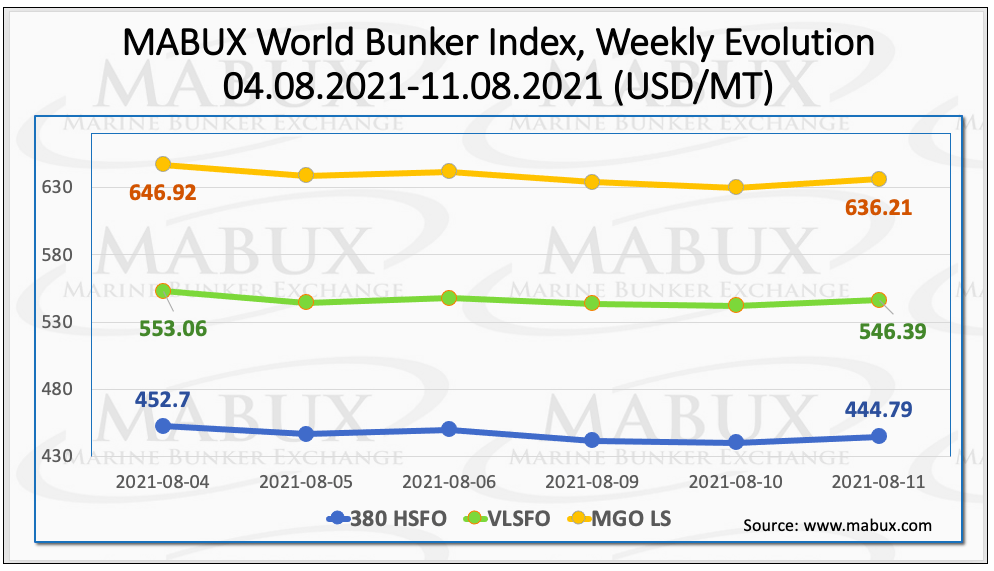

Meanwhile, on Week 32, MABUX World Bunker Index continued its moderate decline. The 380 HSFO index decreased to US$444.79/MT, the VLSFO index fell to US$546.39/MT, while the MGO index decreased to US$636.21, as well.

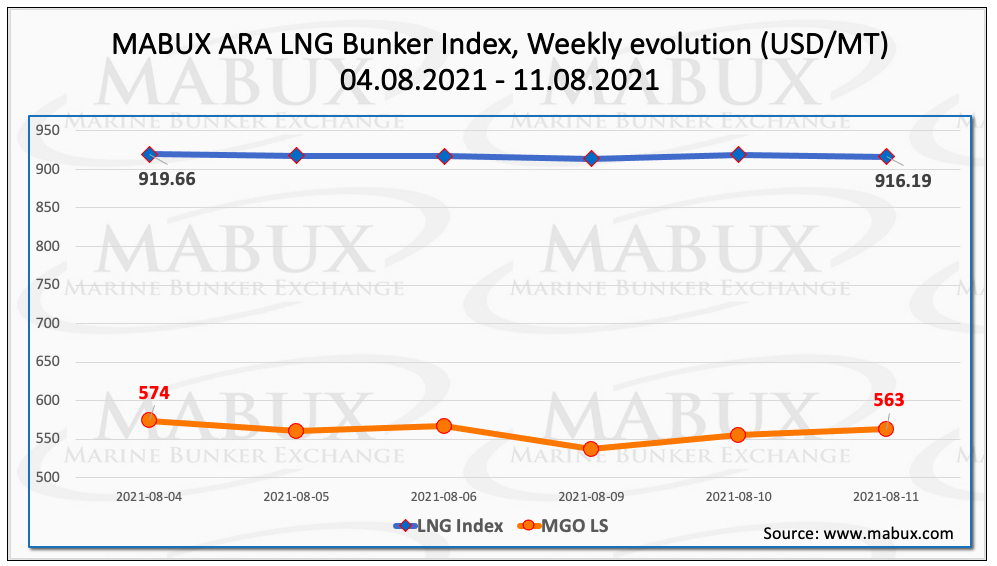

MABUX Amsterdam-Rotterdam-Antwerp (ARA) LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the ARA region, showed a slight decrease in the period of 4- 11 August, reaching US$916.19/MT.

At the same time, the average value of the LNG Bunker Index increased by US$110.87 compared to the previous week. The average price for MGO LS in Rotterdam during the same period decreased by US$26.84/MT, while the average price difference between bunker LNG and MGO LS in Rotterdam increased at US$357.91.

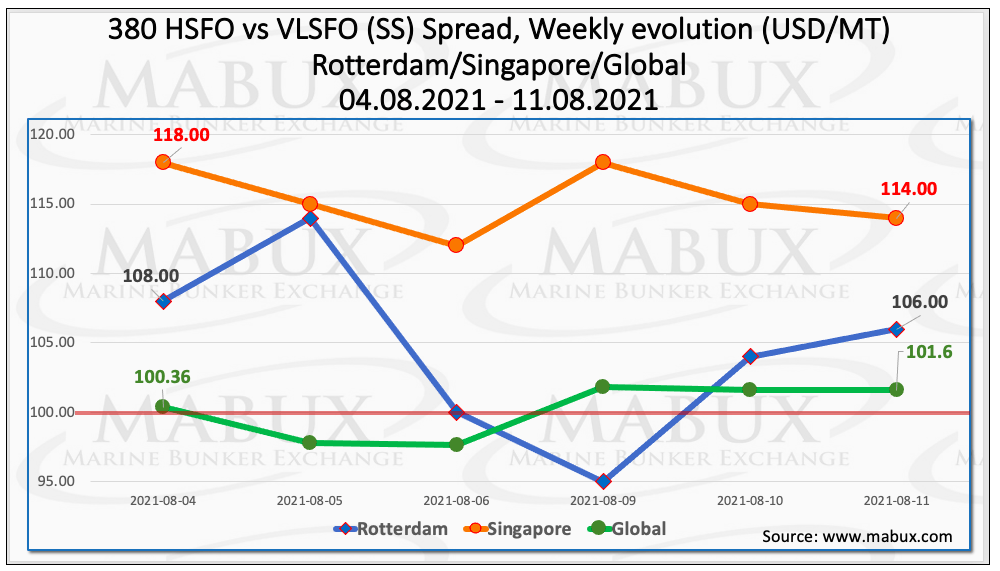

The average weekly Global Scrubber Spread (SS), the difference in price between 380 HSFO and VLSFO, remained almost unchanged at US$100.13 during the week.

In the meantime, the average value of SS Spread in Rotterdam decreased to US$104.50. The SS Spread in Rotterdam also dropped below US$100 twice during the week, while in Singapore, the average SS Spread also fell to US$115.33.

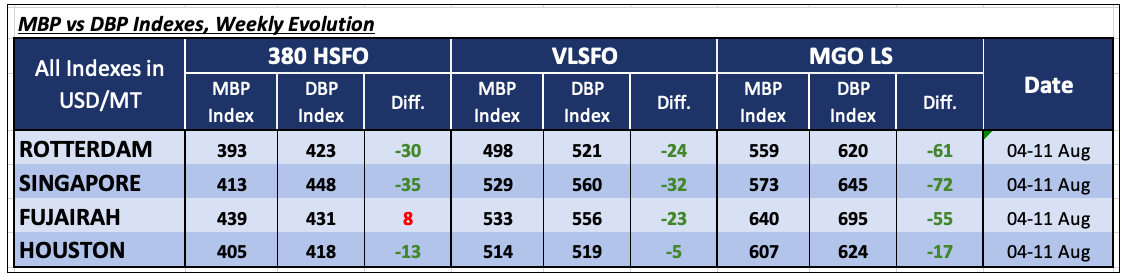

Correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO fuel remained undervalued in all selected ports, except Fujairah, where this type of fuel was overvalued on average by US$8.

In other ports, the underpricing was the following: minus US$13 in Houston, minus US$30 in Rotterdam and minus US$35 in Singapore. “In general, the trend towards a further reduction of underestimation margins in the three ports continues,” commented MABUX.

VLSFO fuel grade, according to the MABUX MBP/DBP Index, was also underestimated in all four selected ports: in Houston, the underpricing was minus US$5, in Rotterdam – minus US$24, in Fujairah – minus US$23 and minus US$32 in Singapore. Fujairah has seen the most significant change in the MBP/DBP Index which is plus US$14.

As for MGO LS, MABUX DBP Index has registered an undercharge of this grade at all selected ports ranging from minus US$17 in Houston to minus US$61 in Rotterdam, minus US$72 in Singapore and minus US$55 in Fujairah. The MGO LS’s MBP/DBP Index has changed irregular, increasing in Rotterdam, and declining in all other ports, according to the MABUX report.

Source : Container News