The “myth” of nefarious blank sailings

Given the current container shipping market, with record-high freight rates, container and vessel capacity shortages, terminal and port congestion, and record-low schedule reliability, it is quite understandable that shippers are getting increasingly frustrated. In stakeholder discussions we have increasingly seen the suggestion, that part of the current rate spike has been manufactured by the carriers, through a “nefarious” use of blank sailings, despite an acute shortage of capacity.

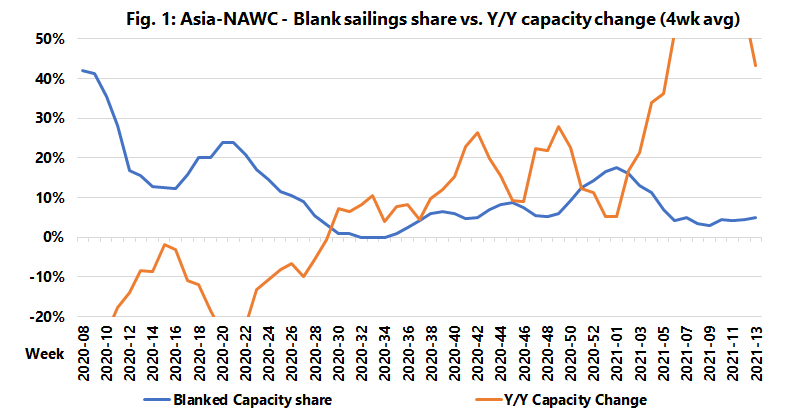

In issue 497 of the Sunday Spotlight, we looked at the hard data to see if this was indeed the case. Using a running 4-week average to eliminate weekly spikes in capacity, which only serves to add noise to the data, figure 1 shows the Asia-North America West Coast blank sailing as a share of planned capacity, versus the Y/Y capacity change. We can clearly see from the figure that the number of blank sailings was extremely high during the Chinese production impact phase of the pandemic in February-March, as well as during the global spread of the pandemic in spring and early summer 2020.

We can also see that briefly, the blank sailings went to zero in late summer, but since then the number of blank sailings has increased again. There was a new spike in blank sailings in late 2020, and early 2021 as well. So there has been increased in the number of blank sailings, despite the current bottleneck problems, but this does not mean that the carriers have also reduced capacity, compared to a year earlier.

As can also be seen in figure 1, the Asia-North America West Coast trade has seen a positive Y/Y capacity injection every month since July 2020. In other words, since July, the amount of capacity brought in through larger vessels and extra loaders has more than exceeded the amount of capacity removed through blank sailings. There have been periods where the growth in capacity injection was pushing 30% Y/Y, despite some sailings being blanked.

We see a similar pattern on Asia-North America East Coast, with a net positive capacity injection since July 2020, while Asia-North Europe has seen a net positive injection of capacity since August, and Asia-Mediterranean since October. The data is thus clear: The carriers have not reduced deployed capacity, despite having blanked some sailings.