US grain exports seen rising 12%, but sailing distances could shorten : BIMCO

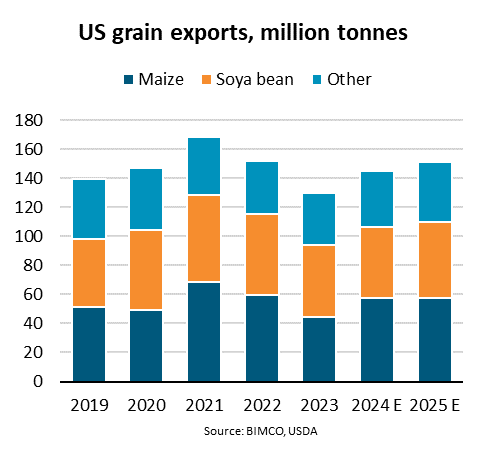

LONDON : “In 2024, grain exports from the US are expected to rise 12% from 2023, driven by a rebound in maize shipments. During the first seven months of 2024, shipments have risen 6% y/y and are expected to further ramp up after the upcoming maize and soya bean harvests in September. Water levels in the Mississippi River are at normal levels which should facilitate the transport of the harvests to seaports,” says Filipe Gouveia, Shipping Analyst at BIMCO.

The US is the second largest grain exporter in the world and 81% of its exports are seaborne. However, its share of global exports has fallen from 24% in 2021 to 18% in 2023 due to competition from Southern Hemisphere exporters, such as Brazil and Argentina, which often export at lower prices.

On the grain import side, China is the world’s largest, importing 23% of global shipments. Over the past three years, it has been diversifying its imports away from the US. In 2021, the US accounted for 37% of grain shipments to China but last year the share declined to 23%. Grain prices have been a key driver, but China has also lifted restrictions on maize shipments from Brazil in 2022 and from Argentina in May this year.

“A recovery in maize shipments from the US would boost the global grain supply, supporting bulk carriers in the panamax, supramax and handysize segments. However, gains from dry bulk demand could be limited. Under regular conditions in the Panama Canal, sailing distances to importing markets in Asia are shorter from the US than from Brazil and Argentina,” says Gouveia.

Between January and July, sailing distances for US grain shipments have stagnated due to a change in destinations. The US has boosted its grain shipments to countries closer to its shores such as Mexico and Colombia, while its shipments to China have fallen 19% y/y.

However, the disruptions in the Panama Canal were still a positive for sailing distances of US grains, as several ships were re-routed around the Cape of Good Hope. Consequently, sailing distances for shipments to East Asia, which typically use the Panama Canal, increased 5% y/y. Gains would have been greater if some cargoes had not been re-routed overland to ports on the West Coast.

“So far in 2024, transit restrictions in the Panama Canal have gradually eased and are expected to have recovered ahead of the peak export season. A return to normal conditions would shorten sailing distances for US grain shipments, limiting gains from stronger volume. However, should shipments to Asia recover, this impact may be limited,” says Gouveia.